Increasing Data Generation

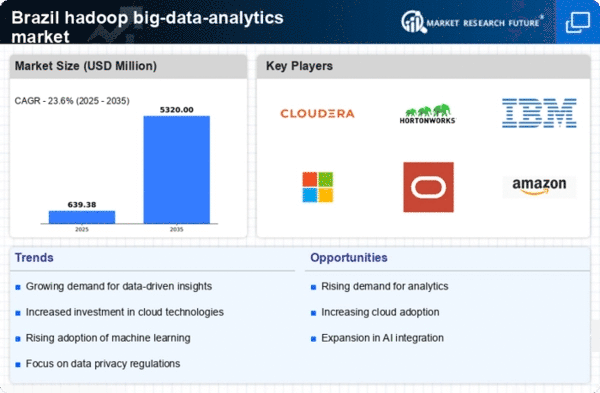

The hadoop big-data-analytics market in Brazil is experiencing a surge due to the exponential growth in data generation across various sectors. With the rise of IoT devices, social media, and e-commerce, organizations are producing vast amounts of data daily. This trend necessitates advanced analytics solutions to derive actionable insights. According to recent estimates, data generation in Brazil is projected to increase by over 30% annually, driving the demand for hadoop-based analytics tools. Companies are increasingly recognizing the need to harness this data effectively, leading to a greater reliance on hadoop technologies. As businesses strive to remain competitive, the ability to analyze large datasets efficiently becomes paramount, thereby propelling the hadoop big-data-analytics market forward.

Growing Need for Real-Time Analytics

The demand for real-time analytics is becoming increasingly pronounced in Brazil, significantly impacting the hadoop big-data-analytics market. Businesses across various sectors, including finance, retail, and healthcare, are seeking to make timely decisions based on real-time data insights. This shift is driven by the need to enhance customer experiences and operational efficiency. As organizations recognize the value of immediate data processing, the adoption of hadoop technologies that support real-time analytics is expected to rise. Market analysts suggest that the real-time analytics segment could account for over 25% of the overall hadoop big-data-analytics market by 2026, indicating a robust growth trajectory fueled by this evolving demand.

Investment in Digital Infrastructure

Brazil's commitment to enhancing its digital infrastructure is a key driver for the hadoop big-data-analytics market. The government has initiated several programs aimed at improving internet connectivity and data center capabilities across the nation. With investments exceeding $1 billion in recent years, the focus on building robust digital frameworks facilitates the adoption of big data technologies. Enhanced infrastructure not only supports the storage and processing of large datasets but also encourages businesses to invest in hadoop solutions. As organizations leverage improved connectivity and data management capabilities, the hadoop big-data-analytics market is likely to witness substantial growth, fostering innovation and efficiency in data handling.

Emergence of Advanced Analytics Techniques

The hadoop big-data-analytics market in Brazil is being propelled by the emergence of advanced analytics techniques, such as machine learning and artificial intelligence. These technologies enable organizations to extract deeper insights from their data, enhancing predictive capabilities and decision-making processes. As businesses increasingly adopt these sophisticated methods, the demand for hadoop solutions that can support complex analytics is likely to grow. Recent studies indicate that the integration of AI with hadoop technologies could lead to a market expansion of approximately 20% by 2027. This trend underscores the importance of advanced analytics in driving innovation and competitiveness within the hadoop big-data-analytics market.

Rising Focus on Data Security and Compliance

In Brazil, the rising focus on data security and compliance is significantly influencing the hadoop big-data-analytics market. With the implementation of stringent data protection regulations, organizations are compelled to adopt robust analytics solutions that ensure compliance while safeguarding sensitive information. The need for secure data handling practices is becoming paramount, particularly in sectors such as finance and healthcare. As companies seek to align their analytics capabilities with regulatory requirements, the demand for hadoop technologies that offer enhanced security features is likely to increase. This trend not only addresses compliance challenges but also fosters trust among consumers, thereby driving growth in the hadoop big-data-analytics market.