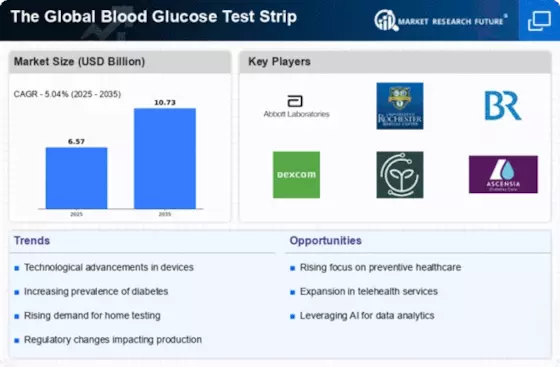

Increasing Prevalence of Diabetes

The rising incidence of diabetes worldwide is a primary driver for The Global Blood Glucose Test Strip Industry. According to recent statistics, the number of individuals diagnosed with diabetes has surged, with estimates suggesting that over 500 million people are currently living with the condition. This alarming trend necessitates regular monitoring of blood glucose levels, thereby propelling the demand for test strips. As healthcare systems strive to manage this chronic disease effectively, the need for accessible and reliable testing solutions becomes paramount. Consequently, manufacturers are focusing on developing innovative test strips that cater to the growing population of diabetic patients, which is likely to further stimulate market growth.

Expansion of Home Healthcare Services

The expansion of home healthcare services is significantly impacting The Global Blood Glucose Test Strip Industry. As more patients prefer to manage their health conditions from the comfort of their homes, the demand for home monitoring devices, including blood glucose test strips, is on the rise. This shift is driven by the convenience and flexibility that home healthcare offers, allowing patients to monitor their glucose levels without frequent visits to healthcare facilities. Furthermore, the increasing aging population, which often requires ongoing diabetes management, is likely to further fuel this trend. As a result, manufacturers are adapting their product offerings to meet the needs of this growing segment.

Growing Awareness of Diabetes Management

There is a notable increase in awareness regarding diabetes management and the importance of regular blood glucose monitoring. Educational campaigns and initiatives by health organizations are contributing to this trend, thereby influencing The Global Blood Glucose Test Strip Industry. As individuals become more informed about the risks associated with uncontrolled blood sugar levels, the demand for test strips is likely to rise. This heightened awareness is particularly evident in emerging markets, where healthcare access is improving, and patients are seeking effective tools for managing their condition. Consequently, this trend may lead to a sustained increase in market demand.

Technological Innovations in Test Strips

Technological advancements play a crucial role in shaping The Global Blood Glucose Test Strip Industry. Innovations such as the development of non-invasive testing methods and smart test strips that integrate with mobile applications are gaining traction. These advancements not only enhance the user experience but also improve the accuracy and reliability of glucose monitoring. For instance, the introduction of test strips that require smaller blood samples has made testing more convenient for patients. As a result, the market is witnessing a shift towards more sophisticated and user-friendly products, which could potentially attract a broader consumer base and drive sales.

Integration with Digital Health Solutions

The integration of blood glucose test strips with digital health solutions is emerging as a key driver in The Global Blood Glucose Test Strip Industry. The proliferation of mobile health applications and wearable devices has created opportunities for seamless data tracking and management. Patients can now easily log their glucose levels, receive real-time feedback, and share data with healthcare providers. This connectivity not only enhances patient engagement but also facilitates better disease management. As technology continues to evolve, the market is expected to see an increase in demand for test strips that are compatible with these digital platforms, potentially leading to improved health outcomes for users.