Blood Flow Measurement Devices Size

Blood Flow Measurement Devices Market Growth Projections and Opportunities

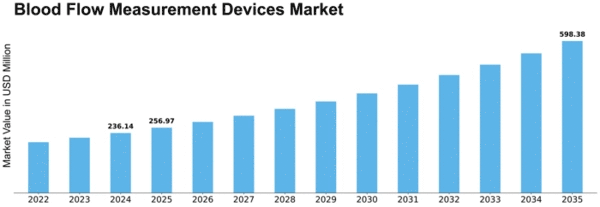

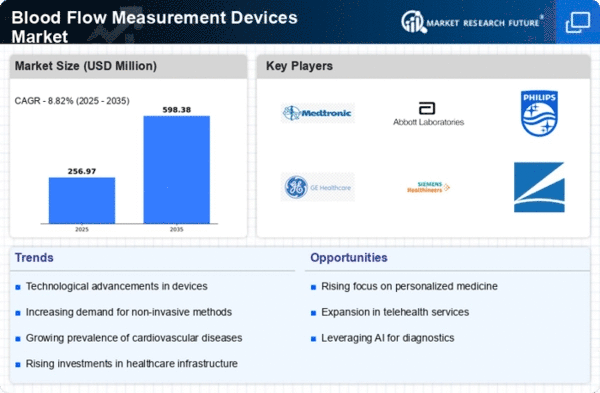

The market size of blood flow measurement devices is expected to get to USD 0.43 billion by 2032, increasing at a rate of 8.8% CAGR throughout the forecast period. Various factors influence the blood flow measurement device market, which plays a crucial role in shaping its dynamics. One thing that drives this market is the growing incidences of heart disease all over the world. This demand for accurate and efficient blood flow measuring instruments increases with this rise in cardiac conditions, which leads to growth in this market. Another factor for consideration includes technological advancements. The integration of ultrasound with Doppler techniques is among the innovations going on in blood flow measuring technologies, making these devices more accurate and reliable. As a result, healthcare institutions continue adopting these technologies because they are continuously evolving. Government initiatives and healthcare policies also exert a substantial impact on the Blood Flow Measurement Devices Market. Therefore, there have been increased initiatives to use advanced diagnostic tools such as blood flow meters through preventive healthcare measures and early detection of diseases like cancer, amongst others. In addition, an increase in awareness has been noted both among health care providers as well as the general population regarding regular health check-ups' importance; this affects the way BFM devices are sold, thus affecting its market shares positively since people want them nowadays for their homes, too. With an increase in information about cardiovascular diseases, prompt availability and use become key drivers for the adoption of these tools into routine clinical practices where screening pre-symptomatic stages would be beneficial. In contrast, campaigns from medical organizations ensure healthier consumer choices by informing patients better, thus fueling sales volumes when promotions shift focus toward preventative solutions. Economic factors also play a role in determining how the Blood Flow Measurement Devices Market shapes its market structure. High levels of economic development usually lead to higher investments made into new medical technology due to rising expenditure on healthcare services, which comes along with growing economies. Willingness among healthcare facilities to invest in high-end blood flow meters encourages significant market growth. Various global partnerships and collaborations animate the healthcare industry. Collaborations with medical device manufacturers, research institutions, and providers of healthcare services have helped facilitate the creation of novel blood flow measurement devices. Finally, the competitive scenario and regulatory framework significantly impact this market's scope for development. Rigorous regulations are there to ensure that such devices are safe and effective, which gives confidence to both physicians and end users. In addition, stiff competition in the market pushes producers continuously to enhance their product offerings, leading to innovation and technological improvement in this field.

Leave a Comment