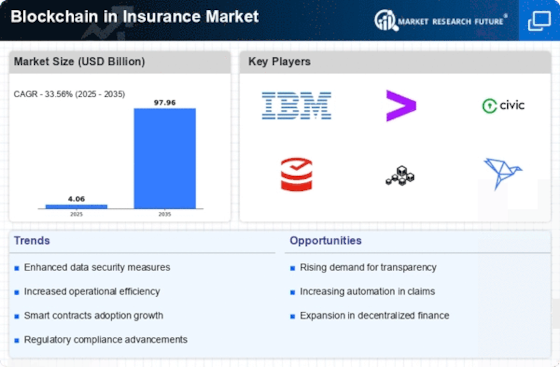

Top Industry Leaders in the Blockchain Insurance Market

Blockchain in Insurance: A Distributed Ledger Disrupting the Industry

The insurance industry, steeped in tradition, is experiencing a revolutionary tremor triggered by blockchain technology. This distributed ledger promises enhanced transparency, streamlined processes, and innovative applications, attracting established players and nimble startups alike. To navigate this dynamic landscape, understanding the key players, their strategies, and the forces shaping the market is crucial.

Key Players:

- Oracle Applied Blockchain

- Microsoft

- Algorythmixi

- Xledger

- Auxesis Group

- Guardtime

- AWS

- Earthport

- BitPay

- Circle

- BTL Group

- ConsenSys.

Strategies for Success:

-

Proof-of-Concept and Pilot Projects: Implementing targeted blockchain pilots in specific areas to showcase the technology's potential and gain insights before large-scale deployment.

-

Collaboration and Ecosystem Building: Partnering with other insurers, technology providers, and startups fosters innovation and accelerates adoption within the wider ecosystem.

-

Regulatory Engagement: Actively collaborating with regulators to develop clear guidelines and address legal uncertainties surrounding blockchain applications in insurance.

-

Focus on User Experience: Simplifying user interfaces and ensuring seamless integration with existing systems are crucial for widespread adoption, especially among traditional insurers.

Factors for Market Share Analysis:

-

Breadth of Blockchain Solutions: Offering a comprehensive suite of blockchain applications across various insurance functions like underwriting, claims processing, and risk management attracts broader interest.

-

Proven Use Cases and Return on Investment: Demonstrating measurable benefits like cost savings, reduced fraud, and improved efficiency through successful blockchain implementations builds trust and encourages wider adoption.

-

Technology Expertise and Partnerships: Possessing robust in-house blockchain expertise or strategic partnerships with leading technology providers fosters innovation and enhances solution development.

-

Industry Recognition and Brand Reputation: A strong brand reputation and active participation in industry consortia builds trust and increases market visibility.

New and Emerging Companies:

-

Decentralized Insurance (DeFi) Platforms: Startups like Nexus Mutual and Cover Protocol are exploring blockchain-based peer-to-peer insurance models, challenging traditional risk pools and offering alternative coverage options.

-

Microinsurance Solutions: Companies like Bwala and Pula use blockchain to provide affordable microinsurance for underserved populations in developing countries, addressing social risks and financial inclusion.

-

Predictive Analytics and Risk Modeling: Startups like Insurwave and SureMatch leverage blockchain and AI to provide personalized risk assessments and dynamically adjust premiums, potentially transforming underwriting practices.

Current Company Investment Trends:

-

Supply Chain Traceability and Transparency: Investing in blockchain solutions for tracking provenance, verifying claims, and combating fraud throughout the insurance value chain is a major focus.

-

Automated Claims Processing: Automating claims processing through smart contracts and secure data sharing on blockchain platforms streamlines operations and reduces costs.

-

Parametric Insurance and Risk Sharing: Exploring blockchain-based parametric insurance models, where payouts are triggered based on objective data parameters, opens up new opportunities for managing specific risks.

-

Data Security and Privacy Enhancements: Ensuring robust data security and privacy measures on blockchain platforms remains a top priority to build trust and comply with regulations.

The Distributed Future:

The blockchain in insurance market is poised for continued growth, fuelled by increasing understanding of its benefits, successful use cases, and regulatory clarity. Understanding the competitive landscape, key players' strategies, and emerging trends will be crucial for established insurers, technology providers, and innovative startups to capitalize on this transformative technology and shape the future of the insurance industry.

Latest Company Updates:

-

Partnerships and collaborations: Leading insurance companies are partnering with blockchain startups and technology providers to develop innovative solutions. -

Consortiums and alliances: Industry players are forming consortiums to establish common standards and accelerate blockchain adoption. -

Regulatory frameworks: Regulatory bodies are working on developing frameworks to address concerns around data privacy and security in blockchain-based insurance applications.