Market Trends

Introduction

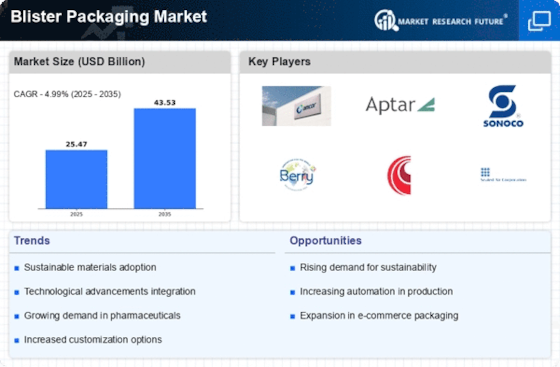

As we approach 2024, the blister pack market is poised to undergo a substantial transformation, driven by a confluence of macro-factors such as technological developments, regulatory changes, and changes in consumer behavior. In particular, innovations in materials and manufacturing processes are enhancing the efficiency and sustainable nature of blister pack solutions, while increasingly stringent regulations, aimed at enhancing the safety and reducing the impact of blister pack solutions on the environment, are reshaping industry standards. Also, as consumers seek greater convenience and product visibility, manufacturers are adopting more sophisticated packaging designs. These trends are strategically important for all market participants, not only because they will influence operational practices but also because they will shape their positioning in an increasingly dynamic market.

Top Trends

-

Sustainability Initiatives

Blister packaging is increasingly focusing on sustainable materials, driven by regulations from governments to reduce plastic waste. Biodegradable and recyclable materials are now available from some manufacturers, like Amcor, with an estimated 30% of its products now made from sustainable materials. This not only meets the growing demand from consumers for sustainable products, but also reflects the goals of the United Nations’ sustainable development goals. Future innovations may include a move towards compostable materials, which will have a further positive impact on the market. -

Smart Packaging Technologies

It is a fact that smart blister packaging is on the increase, and Honeywell is one of the most important companies in this field. Smart packaging can be enhanced with QR codes and NFC technology to increase customer engagement and to provide real-time product information. A recent survey shows that 60 per cent of consumers prefer products with smart packaging. In the coming years, this trend is expected to bring about increased operational efficiency and greater supply chain transparency. -

Regulatory Compliance and Safety Standards

The market for blister packaging is influenced by stricter regulatory requirements, especially in the pharmaceutical sector. Adapting to the new compliance requirements, companies such as ACG Pharmapack are able to ensure that their products meet the safety regulations. A recent survey shows that 75% of pharmaceutical companies place compliance as the main priority when it comes to packaging. This trend will result in further investment in quality assurance and in the latest technological developments. -

Customization and Personalization

In the field of blister packaging, the trend is towards more personalization as a way of differentiating the brand. Uflex, for example, is offering a range of tailor-made solutions, and 40 per cent of consumers prefer a more bespoke package. This will increase loyalty and customer satisfaction, and will lead to an increase in the use of flexible production technology to meet the needs of different customers. -

E-commerce Growth and Packaging Adaptation

With the growth of e-commerce, blister packs have had to be improved to protect products during transport. Retailers report a 50% increase in the demand for protective packaging. This trend will lead to the use of new materials and formats as businesses adapt to the new retail environment. -

Cost Efficiency through Automation

In the field of blister packaging, automation is becoming a must for cost efficiency. Sonoco Products has invested in advanced machinery. Reports say that automation can save up to 20 percent in labor costs. The trend toward automation is expected to enhance productivity and reduce the time it takes to respond to market demands. -

Expansion in Emerging Markets

Rising incomes and urbanization in the emerging countries are the main growth drivers for the blister packaging. Consequently, companies such as Constantia-Flexibles are expanding their operations in the Asia-Pacific region, where the demand for packaged goods is growing. According to current estimates, the emerging markets may account for up to 30 per cent of global consumption of packages by 2025. Competition and product development are likely to increase as a result. -

Health and Safety Focus Post-Pandemic

The pandemic COVID 19 has increased the attention given to the subject of health and safety in the field of packaging, especially in the pharmaceutical and food industries. Companies such as SteriPack Group are increasing the level of their sterilization processes to meet new demands from consumers. Statistics show that 70% of consumers are more concerned with the safety of products now than they were before the pandemic. This trend will lead to increased investment in sterilization technology and materials. -

Integration of Advanced Materials

The use of blister packs with advanced materials is increasing, with a view to enhancing their barrier properties and their long-term stability. Companies like Tekni-Plex are developing materials that extend the shelf-life and improve the protection of products. A study shows that improved barrier properties reduce the rate of spoilage by up to 25%. In the long term, this trend is likely to result in more efficient supply chains and less waste. -

Digital Transformation in Packaging

Blister packaging is changing with digitalization. Using data to make decisions. The Klockner Pentaplast Group uses digital tools to optimize the production process and customer relations. A recent study found that 65% of companies in the packaging industry are investing in digitalization. This trend is expected to improve the process and product development.

Conclusion: Navigating Blister Packaging's Competitive Landscape

The blister packaging market in 2024 is characterized by a very strong competitive environment and significant fragmentation. Both the historical and new players are vying for market share. The trend towards the development of sustainable packaging solutions is a response to the geographical trend towards a more sustainable environment. The historical players have the advantage of their distribution network and brand loyalty, while the new players rely on flexibility and new technologies. Artificial intelligence, automation in production processes and a sustainable mindset will be key factors in determining market share. In this changing environment, strategic investments in flexibility and technological development will be necessary to seize emerging opportunities and meet changing consumer preferences.

Leave a Comment