Blister Packaging Size

Market Size Snapshot

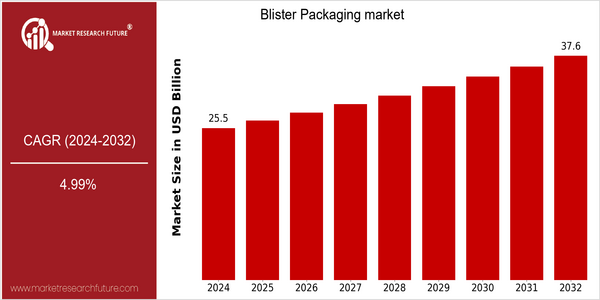

| Year | Value |

|---|---|

| 2024 | USD 25.47 Billion |

| 2032 | USD 37.6 Billion |

| CAGR (2024-2032) | 4.99 % |

Note – Market size depicts the revenue generated over the financial year

Blister Packing is a significant and growing industry. The current market size is projected to reach $37.6 billion by 2032. This represents a CAGR of 4.9 percent over the forecast period. The primary driver for the growth of the market is the increasing demand for cost-effective and efficient packaging solutions across industries. This includes the pharmaceutical, consumer goods, and food and beverage industries. Blister packaging offers tamper-proof and moisture-proof solutions, which makes it a preferred choice for many companies. Also, technological developments, such as the development of eco-friendly materials and the automation of the packaging process, are driving the market. The major players, such as Amcor, West Pharmaceutical Services, and Sonoco Products, are investing in the development of new packaging materials and processes. They are also forming strategic alliances to strengthen their position in the market. Amcor’s recent initiatives to integrate sustainable materials into their blister packaging solutions reflect the industry’s shift towards sustainable practices. These developments will play a key role in shaping the future of the blister packaging industry.

Regional Market Size

Regional Deep Dive

Blister packaging is a packaging method used for the packaging of pharmaceuticals and other products. In North America, the market is characterized by high-tech production and strict regulatory requirements. In Europe, the market is characterized by a shift towards sustainable packaging. The Asian-Pacific region is growing rapidly due to increasing income and urbanization, and the Middle East and Africa are developing due to infrastructural development. Latin America offers a unique opportunity due to its diverse population and its evolving retail landscape, and is therefore a dynamic market for blister packaging.

Europe

- The European Union's Green Deal is driving a significant shift towards eco-friendly blister packaging materials, with companies like Constantia Flexibles leading the way in developing biodegradable options.

- Regulatory changes regarding child-resistant packaging in the EU are prompting manufacturers to innovate in blister design, ensuring safety while maintaining product accessibility.

Asia Pacific

- Rapid urbanization and increasing health awareness in countries like India and China are leading to a surge in demand for blister packaging in the pharmaceutical sector, with companies like Huhtamaki expanding their operations in these markets.

- The rise of e-commerce in Asia-Pacific is influencing blister packaging design, as companies adapt to the need for durable and protective packaging solutions for online deliveries.

Latin America

- The growth of the retail sector in Latin America is leading to increased demand for blister packaging, with companies like Grupo Phoenix investing in local production facilities to meet this demand.

- Regulatory changes in food safety standards are prompting food manufacturers to adopt blister packaging for better product preservation and shelf life.

North America

- The U.S. Food and Drug Administration (FDA) has implemented stricter regulations on pharmaceutical packaging, pushing companies to adopt more secure and compliant blister packaging solutions.

- Innovations in smart packaging technologies, such as QR codes and NFC tags, are being integrated into blister packaging by companies like Amcor and WestRock to enhance consumer engagement and product traceability.

Middle East And Africa

- Government initiatives aimed at improving healthcare infrastructure in the Middle East are boosting the demand for blister packaging in pharmaceuticals, with organizations like the Gulf Cooperation Council (GCC) promoting local manufacturing.

- Cultural preferences for convenience and portability in food packaging are driving innovation in blister packaging designs, particularly in the snack food sector.

Did You Know?

“Blister packaging can reduce product waste by up to 30% compared to traditional packaging methods, making it an environmentally friendly option.” — Packaging World

Segmental Market Size

The Blister Package Division is a very important part of the pharmaceutical and consumer-goods markets, which are currently growing at a steady rate. Product safety and shelf life are two major concerns. The trend toward tamper-evident packages and the stricter regulations aimed at ensuring the integrity of products are two of the main factors driving the market. The development of new packaging technology, such as the use of biodegradable materials, is also a driving force. In general, the market for blister packages is mature, with companies such as Amcor and West Pharmaceutical Services leading the way in the development of new solutions. The two main markets are the pharmaceutical industry, where blister packages are used for the packaging of tablets and capsules, and the consumer-goods industry, where they are used for the packaging of electrical appliances and personal-care products. The increasing demand for sustainable development and the COVID-19 influenza epidemic, which heightened the focus on hygiene and product safety, are accelerating growth. Moreover, digital printing and automation of the packaging process are driving the development of the industry, enhancing both its efficiency and its capacity for individualization.

Future Outlook

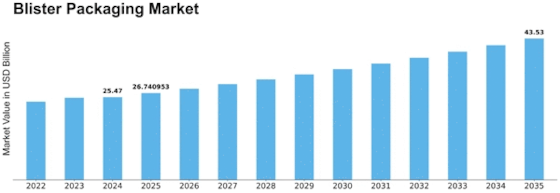

Blister packaging is expected to experience a strong growth between 2024 and 2032. The total market is expected to increase from $24,475,567,000 to $37,683,375,000, at a strong compound annual growth rate (CAGR) of 4.9 percent. The blister package is experiencing strong growth because of the growing demand for pharmaceutical and consumer product packaging. The focus is on product safety, tamper-evident and extended shelf life. The pharmaceutical industry is expected to rely on blister packaging as the world population ages and the number of chronic diseases increases. The penetration of blister packaging in the medical field will thus increase. The development of blister technology is of great importance to the future of the blister package. The development of smart packaging with QR codes and NFC technology for consumer engagement and product traceability is expected to gain in popularity. The use of sustainable materials and manufacturing processes is also expected to increase in line with the global drive to reduce plastic waste. Biodegradable and recyclable blister packages are also expected to increase. These trends will lead to a dynamic market that will bring new opportunities for all market players and will strengthen the position of the blister package as an essential component of many industries.

Leave a Comment