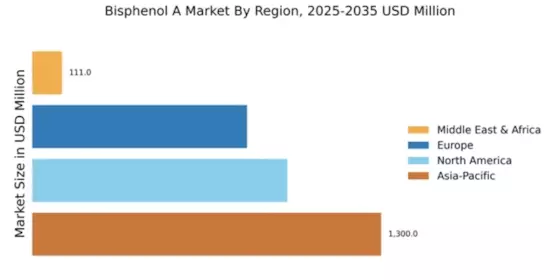

North America : Established Market with Growth Potential

The North American Bisphenol A market is projected to reach $800.0 million by 2025, driven by increasing demand in the automotive and electronics sectors. Regulatory support for sustainable practices and the shift towards eco-friendly materials are key growth catalysts. The region's focus on innovation and technology adoption further enhances market dynamics, positioning it for steady growth in the coming years. Leading countries like the US and Canada dominate the market, with major players such as Dow and Eastman Chemical driving competition. The presence of established manufacturers and a robust supply chain contribute to the region's market strength. As companies invest in R&D, the competitive landscape is expected to evolve, fostering advancements in Bisphenol A applications.

Europe : Regulatory Focus on Sustainability

Europe's Bisphenol A market is valued at $600.0 million, influenced by stringent regulations aimed at reducing environmental impact. The European Union's REACH regulations and initiatives to promote circular economy practices are pivotal in shaping market dynamics. As sustainability becomes a priority, demand for bio-based alternatives is expected to rise, driving innovation in the sector. Germany, France, and the UK are leading countries in this market, with key players like BASF and Covestro actively participating. The competitive landscape is characterized by a mix of established firms and emerging startups focusing on sustainable solutions. As the market adapts to regulatory changes, collaboration among stakeholders will be crucial for future growth.

Asia-Pacific : Dominant Market with High Demand

The Asia-Pacific region leads the Bisphenol A market with a substantial share of $1600.0 million, driven by rapid industrialization and urbanization. The growing demand for plastics in packaging, automotive, and electronics sectors fuels market growth. Additionally, favorable government policies and investments in manufacturing capabilities are significant growth drivers, positioning the region as a manufacturing powerhouse. China, Japan, and South Korea are the primary contributors to this market, with major players like Mitsubishi Chemical and LG Chem at the forefront. The competitive landscape is intense, with numerous local and international companies vying for market share. As demand continues to rise, innovation and strategic partnerships will play a vital role in sustaining growth in this dynamic market.

Middle East and Africa : Emerging Market with Growth Opportunities

The Bisphenol A market in the Middle East and Africa is valued at $160.98 million, with growth driven by increasing industrial activities and rising demand for plastics. The region's strategic location and access to raw materials enhance its potential as a manufacturing hub. Government initiatives aimed at diversifying economies and promoting industrialization are expected to further stimulate market growth. Countries like South Africa and the UAE are leading the market, with a growing presence of key players such as Ineos and Formosa Plastics. The competitive landscape is evolving, with both local and international companies exploring opportunities in this emerging market. As investments in infrastructure and technology increase, the region is poised for significant growth in the Bisphenol A sector.