Growth in End-User Industries

The growth of end-user industries such as automotive, construction, and consumer goods is significantly influencing the Ethoxylated Bisphenol A Market. As these sectors expand, the demand for high-performance materials that incorporate ethoxylated bisphenol A is expected to rise. For instance, the automotive industry is increasingly utilizing advanced coatings and adhesives that require ethoxylated bisphenol A for enhanced durability and performance. This trend is projected to contribute to a market growth rate of approximately 6% annually over the next few years. Consequently, the expansion of end-user industries is a vital driver for the Ethoxylated Bisphenol A Market.

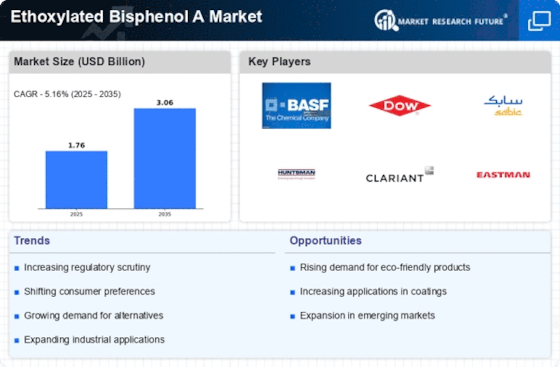

Rising Demand for Eco-Friendly Products

The Ethoxylated Bisphenol A Market is experiencing a notable increase in demand for eco-friendly products. As consumers become more environmentally conscious, manufacturers are compelled to develop sustainable alternatives. This shift is evident in various sectors, including personal care and household products, where ethoxylated bisphenol A serves as a key ingredient. The market for eco-friendly formulations is projected to grow at a compound annual growth rate of approximately 5% over the next five years. This trend not only reflects changing consumer preferences but also encourages innovation in product formulations, thereby driving the Ethoxylated Bisphenol A Market forward.

Technological Advancements in Production

Technological advancements in the production processes of ethoxylated bisphenol A are significantly influencing the Ethoxylated Bisphenol A Market. Innovations such as improved catalytic processes and enhanced purification techniques are leading to higher efficiency and lower production costs. These advancements enable manufacturers to produce high-quality products that meet stringent regulatory standards. Furthermore, the integration of automation and digital technologies in manufacturing is expected to streamline operations, potentially increasing output by 20% in the coming years. As a result, these technological improvements are likely to bolster the competitive landscape of the Ethoxylated Bisphenol A Market.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly stringent, impacting the Ethoxylated Bisphenol A Market. Governments and regulatory bodies are implementing more rigorous guidelines to ensure the safety of chemical products. This trend compels manufacturers to invest in research and development to meet these standards, which may lead to the formulation of safer alternatives. The market is likely to see a shift towards products that comply with these regulations, potentially increasing the market share of compliant ethoxylated bisphenol A formulations. As a result, adherence to safety standards is a critical driver for the Ethoxylated Bisphenol A Market.

Expanding Applications in Various Industries

The versatility of ethoxylated bisphenol A is driving its adoption across various industries, thereby expanding the Ethoxylated Bisphenol A Market. This compound is utilized in a wide range of applications, including coatings, adhesives, and surfactants. The coatings segment, in particular, is projected to witness substantial growth, with an estimated market size increase of 15% by 2026. As industries seek to enhance product performance and durability, the demand for ethoxylated bisphenol A is expected to rise, further solidifying its position in the market. This broad applicability underscores the compound's importance in the Ethoxylated Bisphenol A Market.