Focus on Cost Efficiency

Cost efficiency remains a pivotal driver in the Biotechnology Contract Manufacturing Market. As companies strive to optimize their operational expenditures, outsourcing manufacturing processes to specialized contract manufacturers becomes an attractive option. This trend is particularly evident among small to mid-sized biotech firms that may lack the resources to establish in-house manufacturing capabilities. By leveraging the expertise and infrastructure of contract manufacturers, these firms can significantly reduce costs while maintaining high-quality standards. Recent analyses suggest that the outsourcing of manufacturing can lead to cost savings of up to 30%, thereby reinforcing the attractiveness of the Biotechnology Contract Manufacturing Market for both established and emerging players.

Regulatory Landscape and Compliance

Navigating the complex regulatory landscape is a critical factor influencing the Biotechnology Contract Manufacturing Market. As regulatory bodies impose stringent guidelines on biopharmaceutical production, companies are increasingly reliant on contract manufacturers who possess the necessary expertise to ensure compliance. This reliance is particularly pronounced in regions with rigorous regulatory frameworks, where the cost of non-compliance can be substantial. Contract manufacturers that demonstrate a strong track record in regulatory adherence are likely to gain a competitive edge, as they can assure clients of their ability to meet necessary standards. Consequently, the emphasis on regulatory compliance is shaping the dynamics of the Biotechnology Contract Manufacturing Market.

Rising Demand for Biopharmaceuticals

The increasing prevalence of chronic diseases and the aging population are driving the demand for biopharmaceuticals, which in turn propels the Biotechnology Contract Manufacturing Market. As biopharmaceuticals often require complex manufacturing processes, companies are increasingly outsourcing these functions to specialized contract manufacturers. According to recent data, the biopharmaceutical sector is projected to grow at a compound annual growth rate of over 8% through the next few years. This growth indicates a robust market for contract manufacturing services, as firms seek to enhance production efficiency and reduce costs. The Biotechnology Contract Manufacturing Market is thus positioned to benefit from this rising demand, as manufacturers adapt to meet the specific needs of biopharmaceutical production.

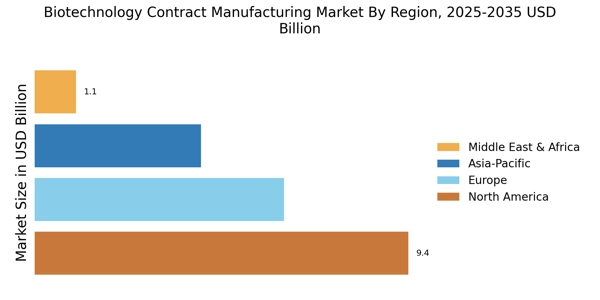

Emerging Markets and Global Expansion

The expansion into emerging markets presents a significant opportunity for the Biotechnology Contract Manufacturing Market. As countries in Asia, Africa, and Latin America enhance their healthcare infrastructure, the demand for biopharmaceuticals is expected to rise. This trend is prompting contract manufacturers to establish operations in these regions to capitalize on the growing market potential. Additionally, the globalization of supply chains allows for more efficient distribution and access to diverse markets. Companies that strategically position themselves in these emerging markets may experience substantial growth, thereby influencing the overall trajectory of the Biotechnology Contract Manufacturing Market.

Advancements in Manufacturing Technologies

Technological innovations are reshaping the Biotechnology Contract Manufacturing Market, enabling more efficient and scalable production processes. The advent of continuous manufacturing, for instance, allows for more streamlined operations, reducing time and costs associated with traditional batch production. Furthermore, the integration of automation and artificial intelligence in manufacturing processes enhances precision and reduces human error. As a result, contract manufacturers are better equipped to meet the increasing demands of clients in the biopharmaceutical sector. The market is witnessing a shift towards more sophisticated manufacturing technologies, which could potentially lead to a more competitive landscape within the Biotechnology Contract Manufacturing Market.