Biorefinery Size

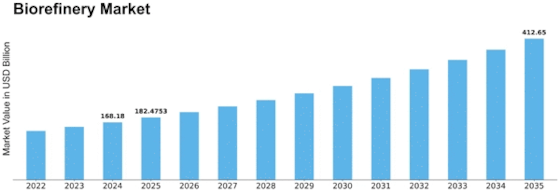

Biorefinery Market Growth Projections and Opportunities

The Biorefinery market is fashioned with the aid of a large number of elements that together impact its development and evolution. One of the number one propellers is the rising global awareness of sustainable and renewable assets of electricity and chemical compounds. Biorefineries play a critical component in this paradigm shift by making use of biomass, which includes agricultural residues and organic waste, to supply a number of treasured merchandise, together with biofuels, biochemicals, and biomaterials. As the sector grapples with concerns related to weather exchange and finite fossil gasoline resources, the demand for Biorefinery answers has witnessed a splendid uptick. Government policies and rules additionally play a crucial element in the steerage of the Biorefinery market. Many nations are imposing supportive regulatory frameworks and incentives to promote the development and adoption of Biorefinery technology. Incentives such as tax credits, subsidies, and renewable electricity mandates inspire corporations to invest in Biorefinery infrastructure, fostering a good environment for marketplace development. Additionally, stringent environmental rules on emissions and waste disposal similarly power the adoption of Biorefinery techniques that align with sustainable practices. Market situations are also impacted by patron cognizance and preferences for sustainable merchandise. As environmental awareness grows amongst purchasers, there may be a growing demand for merchandise derived from renewable sources. Biorefineries cater to this demand by generating bio-based merchandise that provides a decreased environmental footprint in comparison to their traditional opposite numbers. This shift in client choices, in addition, propels the market as industries try to meet sustainability dreams and capitalize on the escalating market for green products. The challenges going through the biorefinery market consist of feedstock availability, technological scalability, and competition with installed fossil gasoline-based total industries. Ensuring a steady and sustainable supply of biomass feedstocks is critical for the uninterrupted operation of biorefineries. Additionally, scaling up Biorefinery methods to meet business needs while preserving monetary feasibility remains a major assignment. Overcoming those demanding situations requires collaborative efforts from industry stakeholders, governments, and study institutions to cope with the technical, logistical, and financial elements of Biorefinery operations. In the give up, the Biorefinery market is intricately impacted by way of a mixture of environmental imperatives, supportive rules, technological developments, patron alternatives, and financial components. As the arena transitions closer to a more sustainable and circular financial system, biorefineries are poised to play an important part in presenting renewable options to conventional industries. Continuous innovation, supportive regulations, and strategic collaborations are vital for unlocking the entire potential of the Biorefinery market and fostering a more sustainable future.

Leave a Comment