Market Trends

Key Emerging Trends in the Biorational Pesticides Market

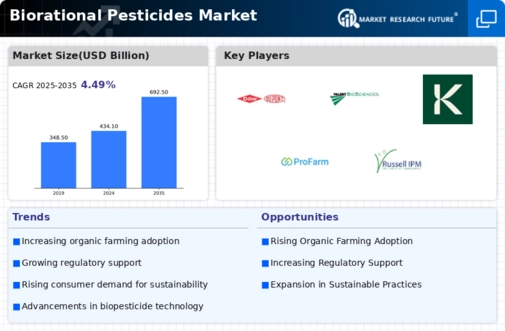

Biorational Pesticides Market is experiencing substantial growth, and companies operating in this sector are implementing various market share positioning strategies. A primary strategy involves ongoing research and development to introduce innovative biorational pesticide formulations. These formulations often leverage natural compounds, beneficial microorganisms, or plant extracts, aiming to provide effective pest control while minimizing environmental impact. Companies that continuously innovate in this space can differentiate their products, attract environmentally conscious consumers, and gain a larger market share.

Strategic collaborations and partnerships play a crucial role in the Biorational Pesticides Market. Companies often engage with agricultural research institutions, biotechnology firms, and environmental organizations to enhance their understanding of biorational solutions and access cutting-edge technologies. Such collaborations contribute to the development of novel formulations, as well as the sharing of knowledge and resources. Partnerships with distribution networks and agricultural cooperatives also help companies expand their market reach and penetrate new regions effectively.

Geographical expansion is a significant strategy as companies seek to tap into diverse agricultural landscapes. The effectiveness of biorational pesticides may vary based on local pest pressures, climate conditions, and crop types. Therefore, companies strategically enter new markets by adapting their formulations to suit specific regional needs, complying with local regulations, and establishing strong distribution networks. By broadening their geographical presence, companies can address the unique challenges faced by farmers globally and increase their market share.

Market penetration is fundamental in the Biorational Pesticides Market, focusing on increasing market share within existing regions. This involves targeted marketing campaigns, educational initiatives, and collaboration with agricultural extension services to create awareness about the benefits of biorational pesticides. Demonstrations, field trials, and providing technical support to farmers are common tactics to boost product adoption and strengthen market penetration.

Sustainability and environmental considerations are integral to market share positioning strategies for biorational pesticides. With growing awareness of the ecological impact of conventional pesticides, farmers and consumers are increasingly seeking sustainable alternatives. Companies that emphasize the eco-friendly nature of their biorational pesticides, highlighting reduced chemical residues, non-toxicity to beneficial organisms, and minimal impact on non-target species, can position themselves favorably and attract environmentally conscious customers, contributing to a larger market share.

Price positioning is a critical strategy wherein companies strategically set the prices of their biorational pesticides. This involves offering competitive pricing, volume discounts, or creating premium formulations with enhanced features. Understanding the cost sensitivity of farmers in different regions and market segments is crucial for effective price positioning, allowing companies to cater to a diverse range of agricultural budgets.

Investment in marketing and education is pivotal for gaining a competitive advantage in the Biorational Pesticides Market. Companies allocate resources to build strong brand identities, create informative marketing materials, and establish educational campaigns. Engaging with farmers, agricultural professionals, and environmental groups through workshops, seminars, and online platforms helps increase awareness and foster positive perceptions, ultimately influencing market share. North America is poised to lead the market share for biorational pesticides throughout the forecast period, driven by the rising demand for organic products in the region. However, the Asia-Pacific market is expected to register the highest Compound Annual Growth Rate (CAGR) during this period, with China and India emerging as the largest country-level markets for biorational pesticides in the region. Factors such as increasing environmental concerns, awareness about the benefits of biorational pesticides, and the expanding cultivation of fruits and vegetables are key drivers boosting the demand for biorational pesticides in the Asia-Pacific region.

Leave a Comment