Biomaterial Size

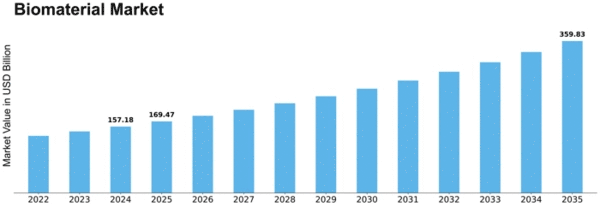

Biomaterial Market Growth Projections and Opportunities

The biomaterials market is driven by numerous factors that cumulatively lead to its development and change. A major factor is the growing number of chronic diseases, especially in an aging world. Biomaterials that include metals and ceramics, polymers as well as composites have an important influence on the production of medical implants, tissue technology or drug-delivering systems. With the increasing need for sophisticated healthcare alternatives, biomaterials become critical to meeting the diverse needs of patients, regenerating tissues, and improving efficacy in medical procedures. Technological developments play a critical role in determining the biomaterials market. Ongoing innovation in biomaterials triggers the emergence of new types with enhanced biological compatibility, mechanical characteristics, and functionality. These innovations not only broaden the scope of applications for biomaterials but also contributes to advancements in personalized and regenerative medicine, which will stimulate growth within this market. The regulatory environment of biomaterials plays a significant role in determining market behavior. Strict regulatory requirements provide a guarantee for the safety, efficacy, and biocompatibility of biomaterials in medical practice. This compliance is necessary for market approval, commercialization purposes as well building trust among the health providers’ patients and regulatory bodies. The adoption of biomaterials depends on the economic factors and health infrastructure in different regions. Differences in health care availability, reimbursement policies and economic factors affect the demand of biomaterials with respect to medical procedures. In order to offer their biomaterial solutions that can meet the challenges posed by a variety of healthcare systems, market players need to cover these different terrains. In the market of biomaterials, there is a constant focus on research and development activities. Companies seek to launch biomaterials with better properties, including bioresorbable, bioactivity and immunological effects. Such highly competitive environment fosters the cycle of innovation where market players should be focused on staying ahead in terms of technological development and contributing to further advancement capabilities that biomaterials have for use within healthcare. Several global health events have had some impact on the biomaterials market. The pandemic highlighted the growing relevance of biomaterials in medical devices, diagnostics as well as vaccine delivery systems. The ability of biomaterials to adapt to different applications was an essential contribution in the fight against urgent needs of healthcare during pandemic. Market innovativeness is due to collaborations between biomaterial manufacturers, research institutions and healthcare organizations. Such collaborations are driven by collective knowledge to combat some challenges in constructing biomaterials through tissue integration, surface modifications and design of bio mimetic materials.

Leave a Comment