Expansion of End-Use Industries

The Biological Polymer Film Market is experiencing growth due to the expansion of end-use industries such as food and beverage, healthcare, and agriculture. As these sectors evolve, there is a rising demand for innovative packaging solutions that align with sustainability goals. For instance, the food and beverage industry is increasingly adopting biological polymer films for packaging to meet consumer preferences for eco-friendly products. Similarly, the healthcare sector is exploring the use of biodegradable films for medical applications, driven by the need for safe and sustainable materials. This expansion across various end-use industries is expected to create new opportunities for manufacturers within the Biological Polymer Film Market, ultimately driving market growth and innovation.

Advancements in Material Science

Innovations in material science are significantly influencing the Biological Polymer Film Market. Recent advancements have led to the development of new biological polymers that exhibit enhanced properties such as improved barrier performance, flexibility, and durability. These innovations are crucial for applications in various sectors, including food packaging, medical devices, and agricultural films. The introduction of novel biopolymers is expected to expand the range of applications for biological polymer films, thereby driving market growth. Furthermore, the integration of nanotechnology into the production of these films may enhance their functionality, making them more appealing to manufacturers and consumers alike. As a result, the Biological Polymer Film Market is poised for substantial growth, fueled by ongoing research and technological breakthroughs.

Growing Awareness of Health and Safety

The Biological Polymer Film Market is witnessing a growing awareness of health and safety concerns associated with traditional plastic materials. As consumers become more health-conscious, there is a rising demand for materials that are not only environmentally friendly but also safe for food contact and medical applications. Biological polymer films, which are derived from renewable resources, are perceived as safer alternatives to conventional plastics. This perception is driving manufacturers to explore the potential of biological polymers in various applications, including food packaging and medical devices. The increasing emphasis on health and safety standards is likely to propel the demand for biological polymer films, thereby contributing to the overall growth of the Biological Polymer Film Market.

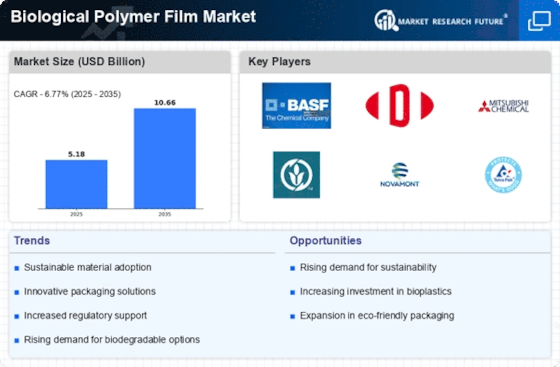

Rising Demand for Eco-Friendly Packaging

The Biological Polymer Film Market is experiencing a notable surge in demand for eco-friendly packaging solutions. As consumers become increasingly aware of environmental issues, there is a growing preference for biodegradable materials over traditional plastics. This shift is driven by the need to reduce plastic waste and its detrimental impact on ecosystems. According to recent data, the market for biodegradable packaging is projected to reach substantial figures, indicating a robust growth trajectory. Companies are now investing in research and development to create innovative biological polymer films that meet consumer expectations while adhering to sustainability standards. This trend not only aligns with consumer preferences but also encourages manufacturers to adopt more sustainable practices, thereby enhancing their market position within the Biological Polymer Film Market.

Increased Regulatory Support for Biodegradable Materials

The Biological Polymer Film Market is benefiting from increased regulatory support aimed at promoting biodegradable materials. Governments across various regions are implementing stringent regulations to curb plastic usage and encourage the adoption of sustainable alternatives. This regulatory landscape is fostering a favorable environment for the growth of biological polymer films, as manufacturers seek to comply with these regulations. For instance, initiatives that mandate the use of biodegradable packaging in specific sectors are likely to drive demand for biological polymer films. As a result, companies are increasingly focusing on developing products that meet regulatory standards, thereby enhancing their competitiveness in the Biological Polymer Film Market. This trend not only supports environmental goals but also opens new avenues for market expansion.