Government Initiatives and Support

Government initiatives aimed at promoting sustainable practices are playing a pivotal role in shaping the Biocomposites Market. Various countries have implemented policies and regulations that encourage the use of renewable materials and reduce reliance on fossil fuels. For example, subsidies and tax incentives for companies utilizing biocomposites in their products are becoming more common. This regulatory support not only fosters innovation but also creates a favorable market environment for biocomposite manufacturers. The Biocomposites Market is likely to benefit from these initiatives, as they enhance the economic viability of biocomposite production and usage. Furthermore, public awareness campaigns about the benefits of biocomposites are expected to increase consumer acceptance, further driving market growth.

Rising Demand for Eco-Friendly Products

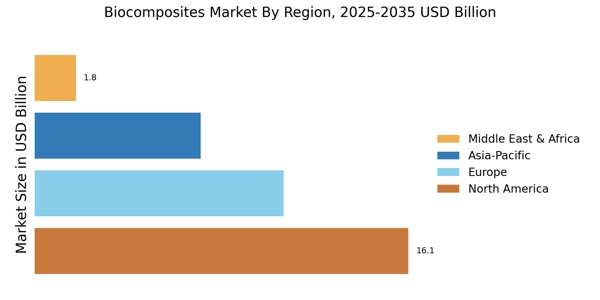

The increasing consumer awareness regarding environmental sustainability appears to drive the Biocomposites Market. As consumers become more conscious of their ecological footprint, the demand for eco-friendly products is likely to surge. This trend is reflected in various sectors, including automotive, construction, and packaging, where biocomposites are increasingly utilized as alternatives to traditional materials. The market for biocomposites is projected to grow at a compound annual growth rate of approximately 12% over the next five years, indicating a robust shift towards sustainable materials. Companies are responding to this demand by innovating and developing new biocomposite formulations that meet both performance and environmental standards. This shift not only enhances brand reputation but also aligns with corporate sustainability goals, further propelling the Biocomposites Market.

Technological Innovations in Material Science

Technological advancements in material science are significantly influencing the Biocomposites Market. Innovations such as improved processing techniques and enhanced material properties are enabling the development of high-performance biocomposites. For instance, the integration of nanotechnology has led to the creation of biocomposites with superior mechanical strength and durability. These advancements are crucial as they allow biocomposites to compete more effectively with conventional materials. The market is witnessing a surge in research and development activities aimed at optimizing biocomposite formulations, which could lead to new applications across various industries. As a result, the Biocomposites Market is expected to expand, driven by the continuous evolution of material technologies that enhance product performance and sustainability.

Consumer Preference for Sustainable Packaging Solutions

The rising consumer preference for sustainable packaging solutions is emerging as a key driver for the Biocomposites Market. As environmental concerns grow, consumers are increasingly seeking products that utilize biodegradable and compostable materials. Biocomposites, with their renewable origins and reduced environmental impact, are well-positioned to meet this demand. The packaging sector is witnessing a notable shift, with biocomposites expected to capture a significant market share. Recent studies indicate that the sustainable packaging market is projected to grow at a rate of 10% annually, which could substantially benefit the Biocomposites Market. Companies are actively exploring biocomposite materials for packaging applications, aligning their products with consumer expectations and regulatory requirements, thereby enhancing their market competitiveness.

Growing Applications in Automotive and Construction Sectors

The expanding applications of biocomposites in the automotive and construction sectors are significantly contributing to the growth of the Biocomposites Market. In the automotive sector, biocomposites are increasingly used for interior components, offering weight reduction and improved fuel efficiency. Similarly, in construction, biocomposites are being utilized for insulation materials and structural components, providing sustainable alternatives to traditional building materials. The automotive industry alone is projected to account for a substantial share of the biocomposites market, with estimates suggesting a growth rate of around 15% in the coming years. This trend indicates a shift towards more sustainable practices in these industries, which is likely to bolster the overall Biocomposites Market.