North America : Market Leader in Biochar

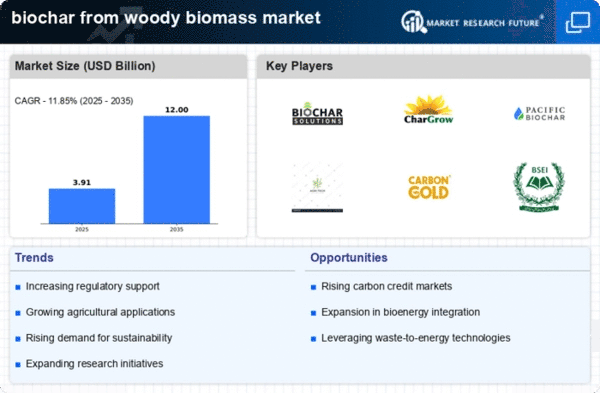

North America is poised to maintain its leadership in the biochar from woody biomass market, holding a significant market share of 1.75 million tons in 2025. The region's growth is driven by increasing environmental regulations promoting carbon sequestration and sustainable agriculture practices. Demand for biochar is also fueled by its applications in soil enhancement and waste management, aligning with the region's sustainability goals. The competitive landscape is robust, featuring key players such as Biochar Solutions, CharGrow, and Pacific Biochar. The U.S. leads the market, supported by favorable policies and investments in renewable energy. The presence of established companies and ongoing research initiatives further solidify North America's position as a hub for biochar innovation and production.

Europe : Emerging Biochar Market

Europe is rapidly emerging as a significant player in the biochar from woody biomass market, with a market size of 1.0 million tons projected for 2025. The region's growth is propelled by stringent environmental regulations and a strong commitment to reducing carbon emissions. Initiatives aimed at promoting circular economy practices and sustainable agriculture are key demand drivers, making biochar an attractive solution for soil health and carbon storage. Leading countries in this market include Germany, France, and the Netherlands, where innovative policies and funding support biochar projects. The competitive landscape features companies like Carbon Gold and BSEI, which are actively involved in research and development. The European Union's commitment to sustainability is evident in its support for biochar initiatives, as stated in the EU Bioeconomy Strategy: "Biochar can play a crucial role in achieving climate neutrality by 2050."

Asia-Pacific : Growing Interest in Biochar

The Asia-Pacific region is witnessing a growing interest in the biochar from woody biomass market, with a projected market size of 0.6 million tons by 2025. This growth is driven by increasing awareness of sustainable agricultural practices and the need for soil improvement solutions. Countries like China and India are focusing on biochar as a means to enhance soil fertility and mitigate environmental issues, supported by government initiatives promoting sustainable farming. The competitive landscape is evolving, with local players beginning to emerge alongside established companies. The presence of key players is still limited, but the potential for growth is significant as more countries adopt biochar technologies. The region's diverse agricultural landscape presents unique opportunities for biochar applications, making it a promising market for future investments.

Middle East and Africa : Untapped Biochar Potential

The Middle East and Africa region represents an untapped market for biochar from woody biomass, with a market size of 0.15 million tons anticipated by 2025. The growth potential is hindered by limited awareness and infrastructure for biochar production. However, increasing interest in sustainable agricultural practices and waste management solutions is beginning to drive demand. Governments are starting to recognize the benefits of biochar for soil enhancement and carbon sequestration, which could catalyze market growth. Countries like South Africa and Kenya are exploring biochar applications, but the competitive landscape remains underdeveloped. Key players are minimal, and local initiatives are just beginning to emerge. As awareness grows and infrastructure develops, the region could see significant advancements in biochar adoption, making it a market to watch in the coming years.