Regulatory Support

Regulatory support is increasingly shaping the landscape of the Bio-Based Polyurethane Market. Governments worldwide are implementing policies and incentives aimed at promoting the use of bio-based materials. These regulations often include tax breaks, subsidies, and grants for companies that invest in sustainable practices. For example, certain regions have established mandates requiring a percentage of materials used in manufacturing to be bio-based. This regulatory framework not only encourages manufacturers to transition to bio-based polyurethanes but also enhances consumer confidence in these products. Market data indicates that regions with strong regulatory support have seen a 15% increase in the adoption of bio-based materials over the past three years. As such, the Bio-Based Polyurethane Market is likely to benefit from ongoing regulatory initiatives that favor sustainable material usage.

Technological Innovations

Technological innovations play a crucial role in advancing the Bio-Based Polyurethane Market. Recent developments in bio-based feedstock processing and formulation technologies have enhanced the performance characteristics of bio-based polyurethanes. For instance, advancements in catalysts and polymerization techniques have improved the efficiency and cost-effectiveness of production processes. Market data suggests that the introduction of new bio-based formulations is expected to capture a significant share of the polyurethane market, potentially reaching 25% by 2030. These innovations not only improve product performance but also expand the application range of bio-based polyurethanes in sectors such as automotive, construction, and furniture. As manufacturers continue to invest in research and development, the Bio-Based Polyurethane Market is likely to experience sustained growth driven by these technological advancements.

Sustainability Initiatives

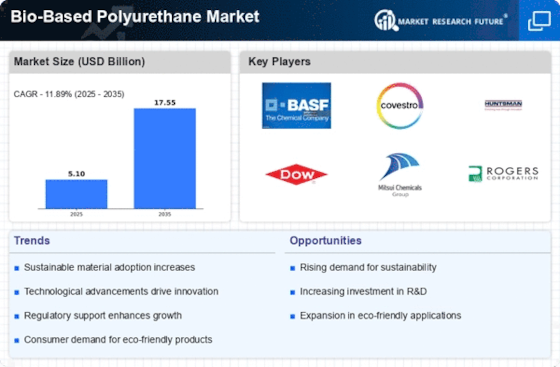

The increasing emphasis on sustainability initiatives is a primary driver for the Bio-Based Polyurethane Market. As consumers and businesses alike become more environmentally conscious, the demand for sustainable materials rises. Bio-based polyurethanes, derived from renewable resources, offer a viable alternative to traditional petroleum-based products. This shift is reflected in market data, which indicates that the bio-based segment is projected to grow at a compound annual growth rate of approximately 10% over the next five years. Companies are increasingly adopting bio-based materials to enhance their sustainability profiles, thereby driving growth in the Bio-Based Polyurethane Market. Furthermore, the integration of sustainable practices into supply chains is likely to bolster the market, as manufacturers seek to meet consumer expectations and regulatory requirements.

Collaboration and Partnerships

Collaboration and partnerships among stakeholders are emerging as a vital driver for the Bio-Based Polyurethane Market. Companies are increasingly forming alliances with research institutions, suppliers, and other manufacturers to foster innovation and accelerate the development of bio-based products. These collaborations often focus on sharing knowledge, resources, and technology, which can lead to more efficient production processes and enhanced product offerings. Market data suggests that partnerships in the bio-based sector have increased by 20% over the past two years, indicating a growing recognition of the benefits of collaborative efforts. As stakeholders work together to overcome challenges and leverage opportunities, the Bio-Based Polyurethane Market is likely to see accelerated growth and innovation.

Consumer Demand for Eco-Friendly Products

The rising consumer demand for eco-friendly products is a significant driver of the Bio-Based Polyurethane Market. As awareness of environmental issues grows, consumers are increasingly seeking products that align with their values. This trend is particularly evident in sectors such as furniture, automotive, and construction, where consumers are willing to pay a premium for sustainable options. Market data reveals that the eco-friendly product segment is expected to grow by 12% annually, reflecting a shift in consumer preferences. Manufacturers are responding to this demand by incorporating bio-based polyurethanes into their product lines, thereby enhancing their market appeal. The Bio-Based Polyurethane Market is thus positioned to thrive as companies adapt to the evolving preferences of environmentally conscious consumers.