Government Initiatives and Incentives

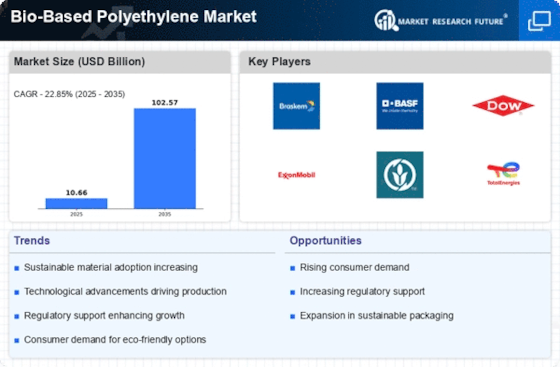

Government initiatives aimed at promoting sustainable practices are likely to bolster the Bio-Based Polyethylene Market. Various countries have implemented policies and incentives to encourage the use of bio-based materials, including tax breaks and subsidies for manufacturers. For instance, certain regions have set ambitious targets for reducing plastic waste, which has led to increased funding for research and development in bio-based alternatives. This regulatory support not only enhances the market appeal of bio-based polyethylene but also encourages innovation within the industry. As a result, the Bio-Based Polyethylene Market is expected to experience accelerated growth, driven by favorable government policies that promote sustainable material usage.

Rising Consumer Awareness of Sustainability

The increasing consumer awareness regarding environmental issues appears to be a pivotal driver for the Bio-Based Polyethylene Market. As individuals become more conscious of their ecological footprint, they tend to favor products that are sustainable and environmentally friendly. This shift in consumer behavior is reflected in market data, indicating that approximately 60% of consumers are willing to pay a premium for sustainable packaging solutions. Consequently, brands are compelled to adopt bio-based materials to meet this demand, thereby propelling the growth of the Bio-Based Polyethylene Market. Companies that align their product offerings with sustainability principles may find themselves at a competitive advantage, as consumers increasingly prioritize eco-friendly options in their purchasing decisions.

Growing Applications Across Various Industries

The expanding applications of bio-based polyethylene across various industries are likely to drive the Bio-Based Polyethylene Market. Sectors such as packaging, automotive, and consumer goods are increasingly integrating bio-based materials into their products. For instance, the packaging industry is projected to account for a significant share of the bio-based polyethylene market, driven by the demand for sustainable packaging solutions. Market data indicates that the packaging segment alone could grow by over 20% in the next five years. This diversification of applications not only enhances the market potential of bio-based polyethylene but also encourages cross-industry collaboration, further solidifying its position within the Bio-Based Polyethylene Market.

Increased Investment in Research and Development

The surge in investment in research and development (R&D) for bio-based materials is poised to be a key driver for the Bio-Based Polyethylene Market. Companies and research institutions are allocating substantial resources to explore innovative bio-based solutions, which could lead to the development of new products and applications. This focus on R&D is essential for overcoming existing challenges related to performance and cost-effectiveness of bio-based polyethylene. Recent trends indicate that investment in R&D for bio-based materials has increased by approximately 15% annually, suggesting a robust commitment to advancing the industry. As breakthroughs emerge from these efforts, the Bio-Based Polyethylene Market is likely to benefit from enhanced product offerings and improved market competitiveness.

Technological Advancements in Production Processes

Technological advancements in the production processes of bio-based polyethylene are emerging as a crucial driver for the Bio-Based Polyethylene Market. Innovations such as improved fermentation techniques and enzymatic processes have enhanced the efficiency and cost-effectiveness of producing bio-based polyethylene. Recent data suggests that these advancements could reduce production costs by up to 30%, making bio-based alternatives more competitive with traditional petroleum-based plastics. As production becomes more efficient, manufacturers are likely to increase their output of bio-based polyethylene, thereby expanding its market share. This trend indicates a promising future for the Bio-Based Polyethylene Market, as technological improvements continue to facilitate broader adoption of sustainable materials.