Innovations in Material Science

Advancements in material science play a crucial role in the evolution of the Bio-Based Foam Market. Researchers and manufacturers are exploring new bio-based feedstocks and production techniques that enhance the performance and reduce the costs of bio-based foams. For instance, the development of new polymerization methods has led to the creation of foams with improved thermal and mechanical properties. Market data suggests that the introduction of innovative materials could potentially increase the market share of bio-based foams by 15% in the next few years, as industries seek alternatives to traditional petroleum-based foams.

Government Incentives and Policies

Government incentives and supportive policies are pivotal in fostering the growth of the Bio-Based Foam Market. Many governments are implementing regulations that encourage the use of renewable materials and provide financial support for companies investing in sustainable technologies. For example, tax credits and grants for research and development in bio-based materials are becoming more common. This regulatory environment not only stimulates innovation but also attracts investments into the Bio-Based Foam Market, potentially leading to a market expansion of over 20% in the coming years as companies capitalize on these opportunities.

Growing Applications Across Industries

The versatility of bio-based foams is leading to their adoption across various industries, which serves as a significant driver for the Bio-Based Foam Market. From packaging to automotive and construction, the applications of bio-based foams are expanding rapidly. For instance, the automotive sector is increasingly utilizing bio-based foams for interior components due to their lightweight and insulating properties. Market analysis indicates that the automotive application segment alone could account for a substantial portion of the market share, potentially reaching 30% by 2026, as manufacturers seek to enhance fuel efficiency and reduce emissions.

Rising Demand for Sustainable Products

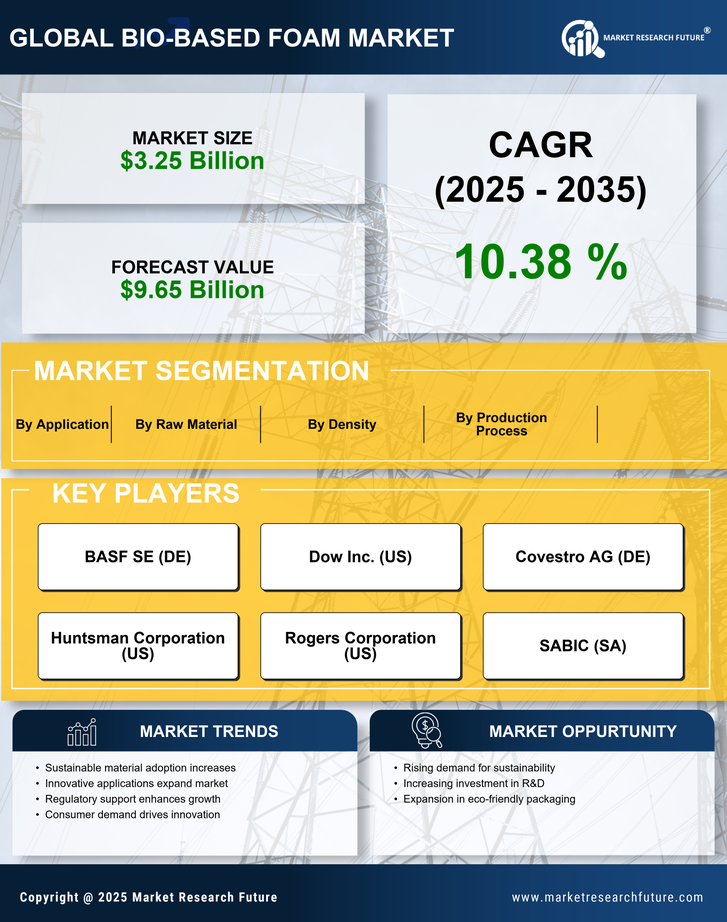

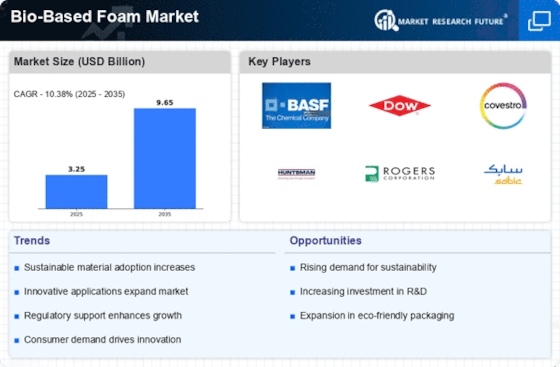

The increasing consumer awareness regarding environmental issues drives the demand for sustainable products, including those in the Bio-Based Foam Market. As consumers become more conscious of their purchasing decisions, they tend to favor products that are eco-friendly and biodegradable. This shift in consumer behavior is reflected in market data, indicating that the demand for bio-based materials is expected to grow at a compound annual growth rate of approximately 12% over the next five years. Companies in the Bio-Based Foam Market are responding by innovating and developing new products that align with these sustainability goals, thereby enhancing their market presence and competitiveness.

Consumer Preference for Healthier Alternatives

There is a noticeable trend among consumers towards healthier and safer alternatives, which is influencing the Bio-Based Foam Market. Traditional foams often contain harmful chemicals that can pose health risks. In contrast, bio-based foams are perceived as safer options, free from toxic substances. This consumer preference is prompting manufacturers to prioritize the development of bio-based products that meet health and safety standards. Market data suggests that the demand for non-toxic and eco-friendly foams is likely to increase by 25% in the next few years, as consumers continue to seek healthier living environments.