バイオベース化学品市場 トレンド

化石燃料資源の枯渇が市場を活性化させる

温室効果ガスの排出増加と化石燃料供給の枯渇により、バイオベースの化学製品市場が拡大しています。これらの要因により、バイオマテリアルの使用が増加しています。危険な排出物を削減するための継続的な取り組みにより、さまざまな分野でのバイオベース製品の使用が支援されています。「グリーンケミストリー」の概念の拡大が、この受け入れ率を加速させるでしょう。危険な化学物質の使用を削減することを支持する政府の施策が、業界を助けるでしょう。

バイオベース化学品市場 運転手

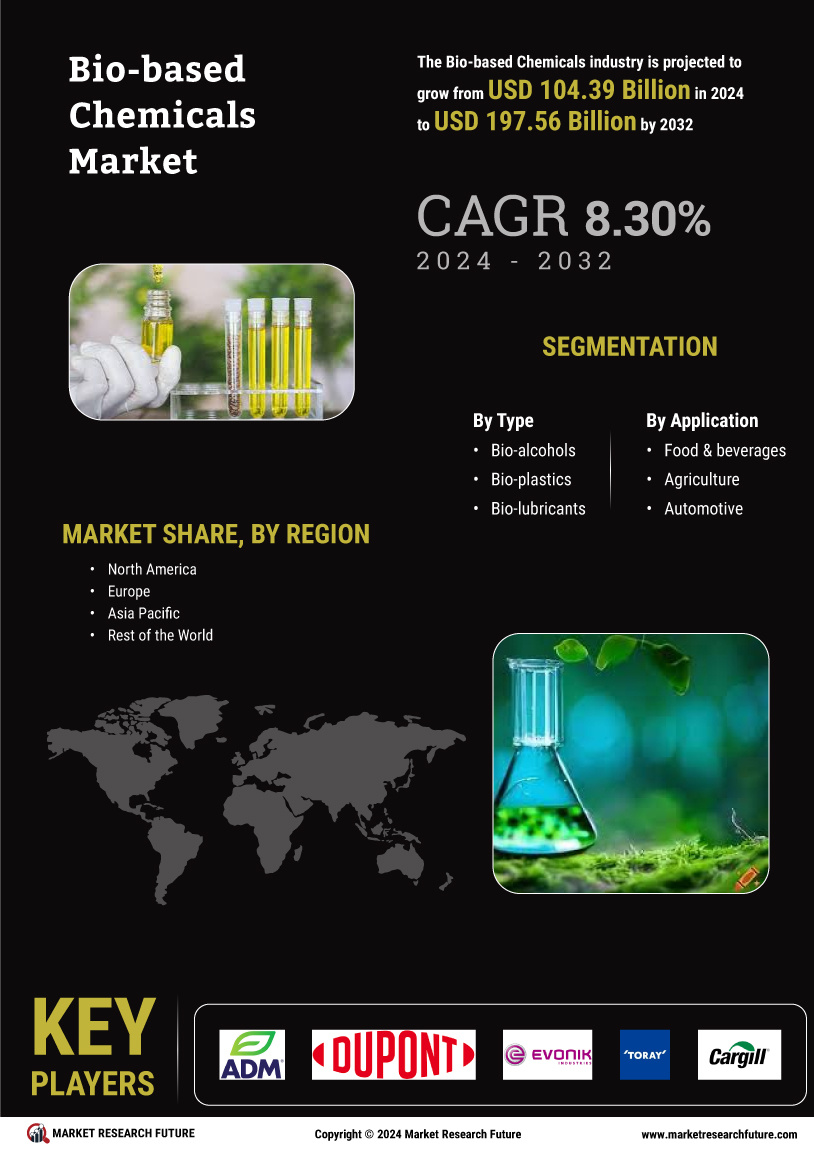

市場成長予測

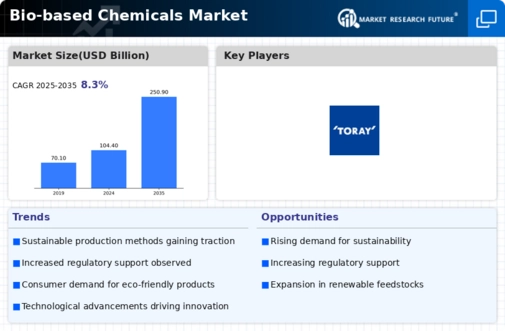

グローバルバイオベース化学市場は、2024年に104.4億米ドルの市場規模に達し、2035年までに250.9億米ドルに増加する見込みで、 substantial growthが期待されています。この成長軌道は、2025年から2035年までの間に8.3%の年平均成長率を示しており、さまざまな分野でのバイオベース化学の採用が増加していることを強調しています。市場の拡大は、持続可能な製品に対する消費者の需要の高まり、政府の支援政策、そして進行中の技術革新といった要因によって推進されています。これらの予測は、バイオベース化学がより持続可能で循環型の経済への移行において重要な役割を果たす可能性を強調しています。

政府の規制と支援

政府の規制は、グローバルなバイオベース化学市場産業の形成において重要な役割を果たしています。多くの国が温室効果ガスの排出を削減し、再生可能資源の使用を促進することを目的とした厳格な規制を実施しています。たとえば、バイオベース化学の生産と使用を奨励する政策がますます一般的になっており、製造業者に対して財政的インセンティブや補助金を提供しています。この規制の支援は、革新を促進するだけでなく、バイオベース技術への投資にとって好ましい環境を作り出します。世界中の政府が持続可能性の目標にコミットする中で、バイオベース化学セクターは大きな利益を得る可能性が高く、グローバルな環境目標に沿った市場成長の軌道につながる可能性があります。

消費者の意識と教育

消費者の意識と教育は、グローバルバイオベース化学市場産業に影響を与える重要な要素です。消費者が自らの選択の環境への影響についてより多くの情報を得るにつれて、バイオベース化学を利用した製品への需要が高まっています。教育的な取り組みやマーケティングキャンペーンは、バイオベースの代替品の利点を効果的に伝えており、これにより消費者のこれらの製品への好みが高まっています。この意識の高まりは、需要を促進するだけでなく、製造業者に革新を促し、バイオベース製品ラインの拡大を奨励します。その結果、消費者の好みがバイオベース化学の軌道を大きく形作るダイナミックな市場環境が生まれ、持続可能性の文化が育まれています。

生産における技術の進歩

技術の進歩は、製造効率を向上させ、コストを削減することによって、グローバルバイオベース化学市場産業を変革しています。合成生物学や代謝工学などのバイオテクノロジーの革新により、より広範な原料からバイオベース化学品を開発することが可能になりました。これらの進展により、高い収率と純度を持つ高付加価値化学品の生産が促進されます。その結果、製造業者は従来の化学品と競争できるバイオベースの代替品を生産できるようになります。2025年から2035年までの年平均成長率8.3%が予測されており、技術革新が市場の拡大を促進する可能性を強調しており、バイオベース化学品がますますアクセスしやすく、経済的に実行可能になることを示しています。

再生可能資源への投資の増加

再生可能資源への投資は、グローバルバイオベース化学市場産業の重要な推進力です。産業が化石燃料からの移行を目指す中、バイオベースの原料開発に向けた資金の増加が顕著です。この投資は研究開発を支援するだけでなく、バイオベース化学製品の生産のスケーラビリティを向上させます。市場は2035年までに250.9億米ドルに成長すると予測されており、持続可能な実践への財政的コミットメントの増加を反映しています。この傾向は、再生可能資源がサプライチェーンに不可欠な存在となり、さまざまな用途におけるバイオベース化学の役割をさらに強固にする産業の風景の変化を示しています。

持続可能な製品への需要の高まり

グローバルバイオベース化学市場は、持続可能な製品に対する需要が顕著に増加しています。消費者と企業は、従来の石油化学製品に代わる環境に優しい選択肢をますます重視しています。この変化は、環境問題への意識の高まりと、カーボンフットプリントを削減したいという願望によって推進されています。その結果、再生可能資源から派生したバイオベース化学品が注目を集めています。市場は2024年に104.4億米ドルに達する見込みであり、包装、繊維、パーソナルケアなどのさまざまな分野で持続可能なソリューションへの好みが高まっていることを反映しています。この傾向は、持続可能性が消費者の核心的な価値となるにつれて、バイオベース化学品の将来が堅調であることを示しています。

市場セグメントの洞察

バイオベースの化学物質タイプの洞察

市場のセグメンテーションは、タイプに基づいて、誘導性バイオアルコール、バイオプラスチック、バイオ潤滑剤、バイオ溶剤、バイオサーファクタント、バイオベース酸を含みます。バイオアルコールのカテゴリーは、市場の最大のシェアを占めています。食品・飲料、製薬、化粧品、パーソナルケアなどの主要な最終用途セクターからの需要の急速な拡大に伴い、です。

バイオベースの化学製品のアプリケーションインサイト

アプリケーションに基づく市場セグメンテーションには、食品・飲料、農業、自動車、パーソナルケア、包装、洗剤・クリーナー、塗料・コーティング、接着剤およびシーラント、製薬、塗料分散が含まれます。塗料・コーティングセグメントは市場を支配すると予想されています。このセグメントにおけるバイオベース化学物質の需要は、環境問題に関連する従来の石油ベースの化学物質に代わる持続可能でエコフレンドリーな選択肢の必要性によって推進されています。

図2:バイオベース化学品市場、タイプ別、2022年および2030年(億米ドル)出典:二次研究、一次研究、市場調査未来データベース、アナリストレビュー

地域の洞察

バイオベース化学品市場市場の主要企業には以下が含まれます

業界の動向

2021年7月:アーチャー・ダニエルズ・ミッドランド社(ADM)は、南ヨーロッパ最大の植物由来タンパク質製造業者であるソヤプロテインの買収に合意しました。ソヤプロテインの買収は、同社の製造能力を向上させ、消費者の栄養ニーズに応えることが期待されています。

2021年6月:トタルエナジーズ、MPGマニファットゥーラ・プラスティカ、フロネリは、認証再生ポリプロピレンから製造されたバイオベースのアイスクリーム用プラスチックカップの商業リリースを発表しました。このバイオベースのナフサ由来の再生ポリプロピレンは、バージンに近い性能を提供し、低いカーボンフットプリントを持ち、完全にリサイクル可能です。

今後の見通し

バイオベース化学品市場 今後の見通し

バイオベースの化学品市場は、2025年から2035年までの間に8.30%のCAGRで成長すると予測されており、持続可能性の取り組み、技術の進歩、エコフレンドリーな製品に対する消費者の需要の増加がその推進要因となっています。

新しい機会は以下にあります:

- [ "革新的なバイオベースの製品フォーミュレーションのための研究開発に投資すること。", "サプライチェーンを拡大し、持続可能性を高め、コストを削減すること。", "デジタルマーケティング戦略を活用して、エコ意識の高い消費者をターゲットにすること。" ]

2035年までに、バイオベースの化学品市場は持続可能な慣行への強力なシフトを反映し、 substantial growth を達成することが期待されています。

市場セグメンテーション

バイオベース化学品の応用展望

- [ "食品・飲料", "農業", "自動車", "パーソナルケア", "包装", "洗剤・クリーナー", "塗料・コーティング", "接着剤・シーラント", "製薬", "塗料分散" ]

バイオベース化学品の種類の展望

- [ "バイオアルコール", "バイオプラスチック", "バイオ潤滑剤", "バイオ溶剤", "バイオサーファクタント", "バイオベース酸" ]

レポートの範囲

| レポート属性/指標 | 詳細 |

| 市場規模 2024 | 1,043.9億米ドル |

| 市場規模 2035 | 2,509.9 (価値 (億米ドル)) |

| 年平均成長率 (CAGR) | 8.30% (2025 - 2035) |

| 基準年 | 2024 |

| 市場予測期間 | 2025 - 2035 |

| 過去データ | 2018 & 2022 |

| 市場予測単位 | 価値 (億米ドル) |

| レポートの範囲 | 収益予測、市場競争環境、成長要因、トレンド |

| カバーされるセグメント | タイプ、アプリケーション、地域 |

| カバーされる地域 | 北米、ヨーロッパ、アジア太平洋、その他の地域 |

| カバーされる国 | アメリカ、カナダ、ドイツ、フランス、イギリス、イタリア、スペイン、中国、日本、インド、オーストラリア、韓国、ブラジル |

| プロファイルされた主要企業 | AGAEテクノロジーズ、TOTAL、ADM、デュポン、エボニックインダストリーズ、トレイインダストリーズ株式会社、カーギル社、GFバイオケミカルズ株式会社、三菱ケミカル株式会社、DSM |

| 主要市場機会 | リグノセルロースバイオリファイナリーの増加、バイオベース化学に関する研究開発 |

| 主要市場ダイナミクス | バイオベースの潤滑剤の需要増加、バイオプラスチックの採用増加、バイオベースのアルコールの応用増加。 |

| 市場規模 2025 | 1,130.6 (価値 (億米ドル)) |

市場のハイライト

FAQs

バイオベースの化学市場はどのくらいの規模ですか?

バイオベースの化学品市場は2024年に1043.9億USDの価値がありました

バイオベース化学市場の成長率はどのくらいですか?

バイオベースの化学品市場は、2025年から2035年の間に8.3%のCAGRを記録する見込みです。

バイオベース化学品市場で最も大きな市場シェアを持っていた地域はどこですか?

アジア太平洋地域はバイオベース化学品市場で最大のシェアを占めていました。

バイオベースの化学品市場の主要なプレーヤーは誰ですか?

市場の主要プレーヤーは、AGAEテクノロジーズ、TOTAL、ADM、デュポン、エボニックインダストリーズ、トーレイインダストリーズ株式会社、カーギル社、GFバイオケミカルズ株式会社、三菱ケミカル株式会社、そしてDSMです。

バイオベース化学品市場をリードしたタイプはどれですか?

バイオアルコールのカテゴリーは2024年に市場を支配しました。

市場で最も大きな市場シェアを持っていたアプリケーションはどれですか?

塗料とコーティングは、バイオベース化学品市場で最大のシェアを占めていました。

このレポートの無料サンプルを受け取るには、以下のフォームにご記入ください

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”