E-commerce Influence

The rise of e-commerce is significantly impacting the Beverage Containers Market. With the increasing popularity of online shopping, consumers are seeking convenient and reliable packaging solutions for their beverages. This trend has prompted manufacturers to adapt their packaging designs to ensure safe and efficient delivery. Data suggests that e-commerce sales of beverages have surged, with a notable increase in demand for ready-to-drink products. Consequently, the Beverage Containers Market is witnessing a shift towards packaging that not only preserves product quality but also enhances the consumer experience during online purchases. This adaptation may lead to innovative packaging solutions that cater specifically to the e-commerce sector.

Regulatory Compliance

Regulatory compliance is a critical driver in the Beverage Containers Market. Governments worldwide are implementing stricter regulations regarding packaging materials and waste management. These regulations aim to reduce environmental impact and promote recycling initiatives. As a result, manufacturers are compelled to adapt their packaging strategies to meet these compliance standards. Data shows that companies investing in compliant packaging solutions are likely to gain a competitive edge, as consumers increasingly favor brands that demonstrate environmental responsibility. The Beverage Containers Market is thus experiencing a shift towards innovative packaging that not only adheres to regulations but also resonates with eco-conscious consumers, potentially leading to increased market share.

Health and Wellness Trends

Health and wellness trends are becoming a driving force in the Beverage Containers Market. As consumers increasingly prioritize health-conscious choices, there is a growing demand for beverages that promote well-being. This shift has led to the introduction of functional drinks, such as those enriched with vitamins, minerals, and probiotics. Consequently, manufacturers are focusing on packaging that highlights these health benefits, often utilizing transparent or informative designs. Market data indicates that the demand for health-oriented beverages is expected to grow at a rate of approximately 6% annually. This trend not only influences product development but also shapes the packaging strategies within the Beverage Containers Market, as brands strive to communicate their health benefits effectively.

Sustainability Initiatives

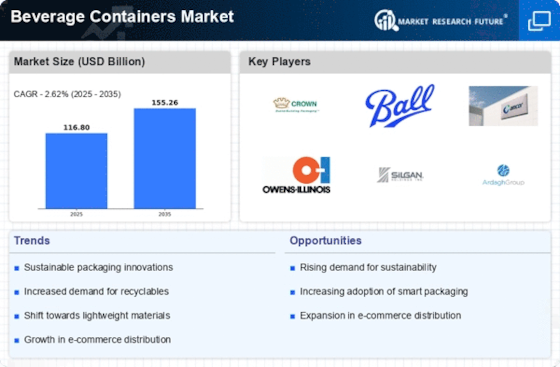

The Beverage Containers Market is increasingly influenced by sustainability initiatives. Consumers are becoming more environmentally conscious, leading to a rising demand for eco-friendly packaging solutions. This shift is evident as companies adopt recyclable and biodegradable materials for their beverage containers. According to recent data, the market for sustainable packaging is projected to grow significantly, with a compound annual growth rate of over 5% in the coming years. This trend not only aligns with consumer preferences but also encourages manufacturers to innovate in their packaging designs. As a result, the Beverage Containers Market is likely to see a surge in the development of sustainable products, which could enhance brand loyalty and attract a broader customer base.

Technological Advancements

Technological advancements play a crucial role in shaping the Beverage Containers Market. Innovations in materials science have led to the development of lighter, stronger, and more efficient containers. For instance, the introduction of advanced polymers and composites has improved the durability and shelf life of beverages. Furthermore, automation and smart manufacturing processes are streamlining production, reducing costs, and enhancing quality control. Data indicates that the adoption of these technologies could lead to a reduction in production waste by up to 20%. As manufacturers continue to invest in research and development, the Beverage Containers Market is expected to experience enhanced efficiency and product offerings, catering to the evolving needs of consumers.