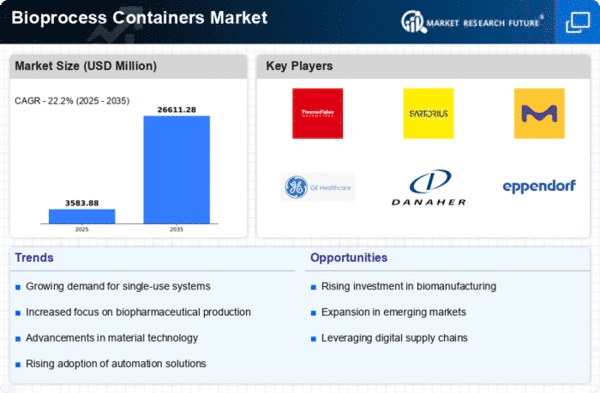

Market Growth Projections

The Global Bioprocess Containers Market Industry is projected to experience substantial growth, with estimates indicating a rise from 2.93 USD Billion in 2024 to 26.6 USD Billion by 2035. This remarkable increase reflects a CAGR of 22.21% from 2025 to 2035, highlighting the escalating demand for bioprocess containers in biopharmaceutical manufacturing. The growth trajectory suggests a robust market environment, driven by various factors including technological advancements, increasing biopharmaceutical production, and a focus on sustainability. As the industry evolves, stakeholders are likely to witness significant opportunities for innovation and expansion.

Focus on Sustainable Practices

Sustainability has emerged as a pivotal concern within the Global Bioprocess Containers Market Industry. Manufacturers are increasingly adopting eco-friendly materials and practices in the production of bioprocess containers. This shift not only addresses environmental concerns but also aligns with regulatory requirements and consumer preferences for sustainable products. The emphasis on sustainability is likely to drive innovation in bioprocess container design and materials, fostering a competitive edge in the market. As sustainability becomes a core value for companies, the demand for environmentally responsible bioprocess containers is expected to rise, contributing to the industry's growth.

Regulatory Support and Compliance

Regulatory frameworks play a crucial role in shaping the Global Bioprocess Containers Market Industry. Governments worldwide are establishing guidelines and standards to ensure the safety and efficacy of biopharmaceutical products. This regulatory support is likely to enhance the credibility of bioprocess containers, encouraging their adoption across various manufacturing processes. Compliance with stringent regulations necessitates the use of high-quality bioprocess containers, which can withstand the rigors of biopharmaceutical production. As regulatory landscapes evolve, the demand for compliant bioprocess containers is expected to grow, further driving market expansion.

Rising Demand for Biopharmaceuticals

The Global Bioprocess Containers Market Industry is experiencing a surge in demand for biopharmaceuticals, driven by the increasing prevalence of chronic diseases and the aging population. As biopharmaceuticals often require complex manufacturing processes, bioprocess containers have become essential for ensuring the safe and efficient production of these therapies. The market is projected to grow from 2.93 USD Billion in 2024 to an impressive 26.6 USD Billion by 2035, reflecting a compound annual growth rate (CAGR) of 22.21% from 2025 to 2035. This growth underscores the critical role of bioprocess containers in meeting the evolving needs of the biopharmaceutical sector.

Increasing Investment in Biotech Research

The Global Bioprocess Containers Market Industry is bolstered by rising investments in biotechnology research and development. Governments and private entities are increasingly funding biotech initiatives, recognizing the potential for innovative therapies and solutions. This influx of capital is likely to enhance the development of new biopharmaceuticals, thereby driving the demand for bioprocess containers. As research progresses, the need for efficient and reliable bioprocessing solutions becomes paramount, further solidifying the role of bioprocess containers in the biotechnology landscape. The trend indicates a promising outlook for the market as research initiatives expand.

Technological Advancements in Manufacturing

Technological innovations in manufacturing processes are significantly influencing the Global Bioprocess Containers Market Industry. The introduction of single-use technologies and automation in bioprocessing has streamlined operations, reduced contamination risks, and improved overall efficiency. These advancements enable manufacturers to respond swiftly to market demands while maintaining high-quality standards. As a result, the adoption of bioprocess containers is likely to increase, facilitating the production of a diverse range of biopharmaceutical products. The ongoing evolution in manufacturing technologies suggests a robust future for bioprocess containers, aligning with the industry's growth trajectory.