Benzenoid Size

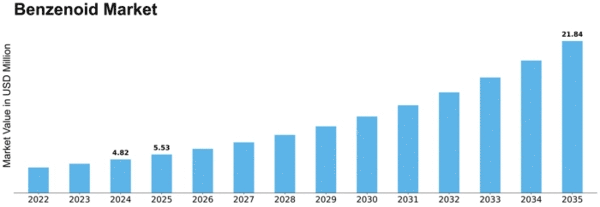

Benzenoid Market Growth Projections and Opportunities

The Benzenoid market plays a role along with a number of the factoers the majority of which have an effect on the market´s patterns and its growth. Indisputably, the main catalyst is the continually growing need to implement benzenoid compounds in pharmaceutical, fragrance and agrochemical companies. Benzenoids constitute aroma affected chemical molecules that act as foundation blocks in the production of different chemical composites which are associated with the entire pharmaceuticals, perfumes and agricultural ventures.

The Benzenoid market being highly regulated featuring standards veys a key role in it. The regulation bodies in place are to limit the polluting capacity of these hydrocarbons and prevent adverse effects on the environment as well human health. Besides guaranteeing the safety and the sustainably of benzenoid-based products, manufacturers' compliance with these regulations also influences industry efforts to practice responsible behavior and aligned with global goals of environmental conservation.

The global economic climate if frequently directly the Benzech market. The exchange rates of the currencies, the geopolitical vagaries, and important macroeconomic statistics (such as inflation and fluctuation in output) can greatly affect production costs, pricing, and the general stability of the market. The other reason is that economic downturn of basic industries, such as pharmaceuticals and cosmetics, has immediate negative effect on the demand of benzenoid compounds which are the essential constituents of end-product formulation. Traders and suppliers who work in such a market face the necessity to keep pace with and to get used to new economic conditions in order to make the business right and quality decisions.

Technology and innovation are the axial factors boosting the Benzenoid market. Discoveries of new synthesis methods, techniques for purification, and the applications in benchmarking compounds are arise due to continuity of research and development activities. The introduction of new methodologies during the manufacturing process, however, boosts productivity, allowing the manufacturers to supply the high demand for variations of benzenoids while remaining profitable and with minimal environmental impact.

End-user inclination on use of Benzenoids and trends in the industry influences the market characteristics of Benzenoids. There has been a transformation in fragrance and cosmetics industries where the need of natural and sustainable commodities has pushed the market to bio-based benzenoid compounds. Besides, the research activities for the drug discovery and development by the pharmaceutical industry which are aimed at generating new benzenoid derivatives with advanced therapeutic profiles.

The proximity or distance from the country of origin can create different demand patterns in the Benzenoid market. The micro economic management of European Union member countries through varying regional regulations, raw materials availability, and industry requirements limit the market dynamics in different areas of the world. Regional differences mandate unique market approaches from manufacturers, including full compliance with local standards and adapting to regional market exigencies ( e. g. trade deals, cultural, and legislative preferences).

Leave a Comment