Growing Energy Storage Applications

The increasing need for energy storage solutions is another significant driver of the Battery Production Machine Market. With the rise of renewable energy sources such as solar and wind, there is a pressing demand for efficient energy storage systems to balance supply and demand. The Battery Production Machine Market is anticipated to reach USD 200 billion by 2026, creating a substantial opportunity for battery manufacturers. This surge in energy storage applications necessitates advanced battery production technologies to ensure high performance and reliability. Consequently, the Battery Production Machine Market is poised for growth as manufacturers strive to meet the requirements of this expanding sector.

Rising Demand for Electric Vehicles

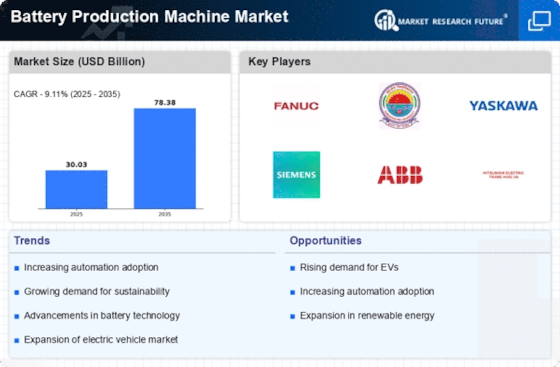

The increasing demand for electric vehicles (EVs) is a primary driver of the Battery Production Machine Market. As consumers and manufacturers alike shift towards sustainable transportation solutions, the need for efficient battery production has surged. In 2025, the EV market is projected to grow at a compound annual growth rate (CAGR) of approximately 20%, necessitating advanced battery production technologies. This trend compels manufacturers to invest in state-of-the-art battery production machines to meet the escalating demand for high-capacity batteries. Consequently, the Battery Production Machine Market is likely to experience substantial growth as automakers seek to enhance their production capabilities to keep pace with the evolving automotive landscape.

Government Regulations and Incentives

Government regulations and incentives aimed at promoting clean energy solutions are pivotal in driving the Battery Production Machine Market. Many countries are implementing stringent emissions standards and offering tax incentives for electric vehicle production, which in turn boosts the demand for efficient battery production. For example, various governments have set ambitious targets for EV adoption, which necessitates the establishment of robust battery manufacturing infrastructures. This regulatory environment encourages investments in battery production technologies, thereby propelling the growth of the Battery Production Machine Market. As a result, manufacturers are likely to enhance their production capabilities to comply with these regulations and capitalize on available incentives.

Shift Towards Sustainable Manufacturing Practices

The shift towards sustainable manufacturing practices is increasingly influencing the Battery Production Machine Market. As environmental concerns gain prominence, manufacturers are adopting eco-friendly production methods and materials. This trend is driven by consumer preferences for sustainable products and the need to comply with environmental regulations. Companies are investing in battery production machines that minimize waste and energy consumption, thereby enhancing their sustainability profiles. The market for sustainable battery production technologies is projected to grow significantly, reflecting the industry's commitment to reducing its environmental footprint. As a result, the Battery Production Machine Market is likely to witness a transformation as manufacturers align their operations with sustainability goals.

Technological Innovations in Battery Manufacturing

Technological advancements play a crucial role in shaping the Battery Production Machine Market. Innovations such as automated assembly lines, advanced robotics, and artificial intelligence are revolutionizing battery manufacturing processes. These technologies enhance production efficiency, reduce costs, and improve product quality. For instance, the integration of AI in production lines can optimize the manufacturing process by predicting equipment failures and minimizing downtime. As manufacturers adopt these cutting-edge technologies, the Battery Production Machine Market is expected to expand significantly, with a projected market size reaching USD 5 billion by 2026. This growth reflects the industry's commitment to embracing innovation to meet the demands of modern battery applications.