Growing Renewable Energy Sector

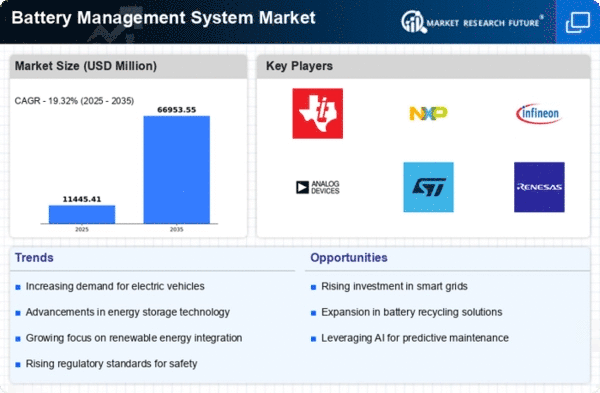

The expansion of the renewable energy sector is significantly influencing the Global Battery Management System Market Industry. As countries invest in solar and wind energy, the need for efficient energy storage solutions becomes paramount. Battery management systems are essential for optimizing the performance of energy storage systems, ensuring reliability and longevity. The increasing deployment of renewable energy sources necessitates advanced battery management solutions to manage energy flow and storage effectively. This trend is expected to drive market growth, as the global energy landscape shifts towards sustainability and resilience, with the market projected to reach 79.7 USD Billion by 2035.

Rising Demand for Electric Vehicles

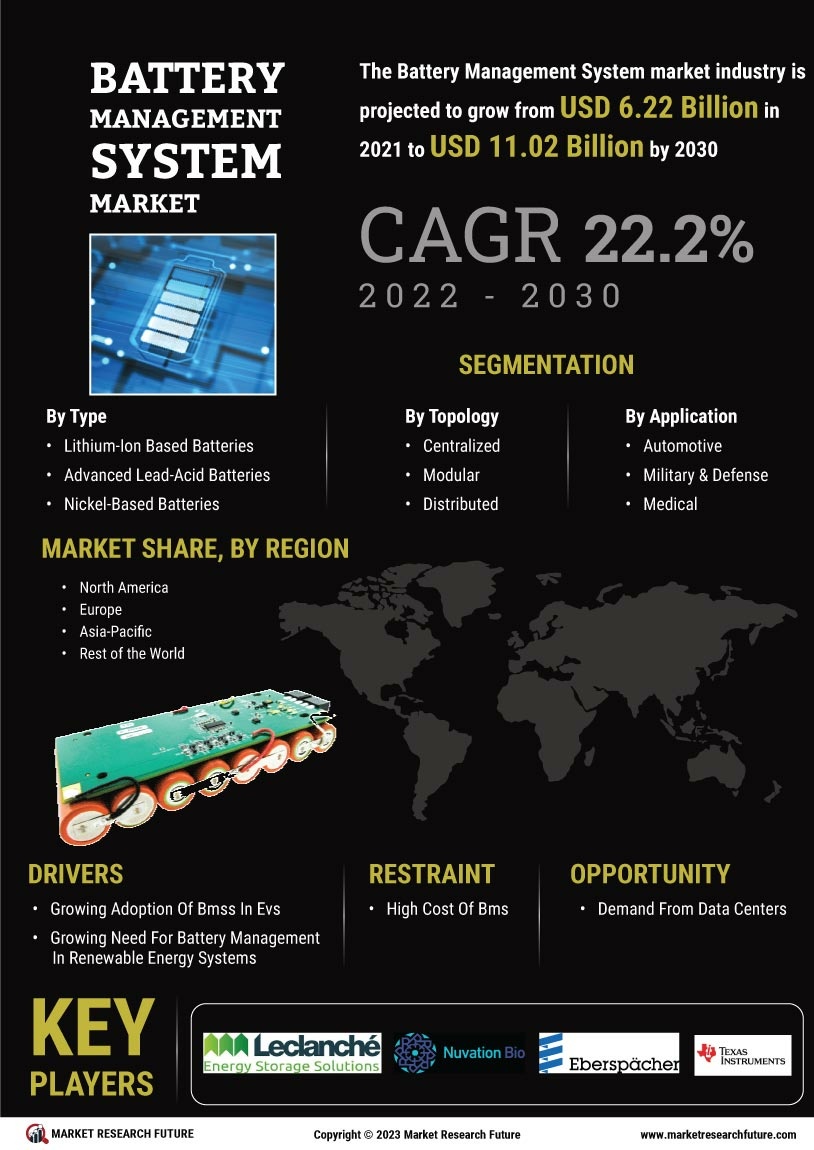

The increasing adoption of electric vehicles (EVs) is a primary driver for the Global Battery Management System Market Industry. As governments worldwide implement stringent emission regulations and promote sustainable transportation, the demand for EVs is expected to surge. In 2024, the market is projected to reach 9.59 USD Billion, reflecting the growing need for efficient battery management solutions. Battery management systems play a crucial role in optimizing battery performance, enhancing safety, and extending lifespan, which are essential for EV manufacturers. This trend is likely to continue, with the market anticipated to expand significantly as EV sales increase.

Increasing Focus on Energy Efficiency

The global emphasis on energy efficiency is a critical driver for the Global Battery Management System Market Industry. As industries and consumers seek to reduce energy consumption and operational costs, battery management systems are becoming integral to energy management strategies. These systems enable better monitoring and control of battery usage, leading to enhanced efficiency and reduced waste. Governments and organizations are increasingly adopting policies that promote energy efficiency, further fueling the demand for advanced battery management solutions. This growing focus on sustainability and efficiency is likely to contribute to the market's expansion in the coming years.

Emerging Applications in Consumer Electronics

The proliferation of consumer electronics is a notable factor driving the Global Battery Management System Market Industry. With the rise of portable devices, such as smartphones, tablets, and wearables, the demand for efficient battery management solutions is escalating. These devices require advanced battery management systems to ensure optimal performance, safety, and longevity. As consumer preferences shift towards longer-lasting and faster-charging devices, manufacturers are increasingly investing in innovative battery management technologies. This trend is expected to sustain market growth, as the consumer electronics sector continues to evolve and expand.

Technological Advancements in Battery Technologies

Technological innovations in battery technologies, such as lithium-ion and solid-state batteries, are propelling the Global Battery Management System Market Industry forward. These advancements enhance energy density, reduce charging times, and improve overall battery efficiency. As manufacturers strive to develop more efficient and longer-lasting batteries, the demand for sophisticated battery management systems becomes increasingly critical. The integration of smart technologies, such as artificial intelligence and machine learning, into battery management systems further optimizes performance and safety. This trend indicates a robust growth trajectory for the market, with projections suggesting a compound annual growth rate of 21.22% from 2025 to 2035.