North America : Market Leader in Consulting Services

North America continues to lead the Bankruptcy and Insolvency Consulting Services market, holding a significant share of 8.25 in 2024. The region's growth is driven by a robust economy, increasing corporate bankruptcies, and evolving regulatory frameworks that support restructuring efforts. Demand for expert consulting services is on the rise as businesses seek to navigate complex financial landscapes and optimize their operations amidst economic uncertainties.

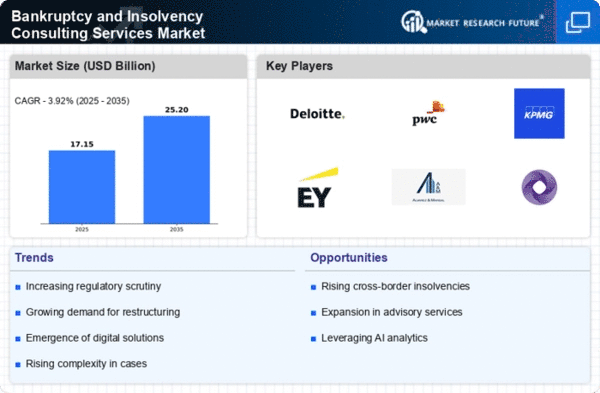

The competitive landscape is characterized by the presence of major players such as Deloitte, PwC, and KPMG, which dominate the market with their extensive service offerings. The U.S. remains the largest contributor, with a strong focus on innovation and technology integration in consulting practices. This competitive environment fosters continuous improvement and adaptation, ensuring that clients receive top-tier services tailored to their specific needs.

Europe : Emerging Market with Growth Potential

Europe's Bankruptcy and Insolvency Consulting Services market is poised for growth, with a market size of 4.5 in 2024. The region is experiencing a resurgence in demand for consulting services due to economic recovery efforts and regulatory changes aimed at facilitating smoother insolvency processes. Countries are increasingly adopting frameworks that encourage restructuring, thus driving the need for expert guidance in navigating these complexities.

Leading countries such as Germany, France, and the UK are at the forefront of this market, with a competitive landscape featuring firms like BDO and RSM. The presence of established consulting firms enhances service delivery, while local regulations promote transparency and efficiency in insolvency proceedings. As businesses adapt to changing economic conditions, the demand for specialized consulting services is expected to rise significantly.

Asia-Pacific : Growing Demand for Consulting Services

The Asia-Pacific region is witnessing a growing demand for Bankruptcy and Insolvency Consulting Services, with a market size of 2.75 in 2024. Economic fluctuations and increasing corporate debt levels are driving the need for expert consulting services. Governments are also implementing regulatory reforms to streamline insolvency processes, which further fuels market growth. The region's diverse economies present unique challenges and opportunities for consulting firms.

Countries like Australia, Japan, and India are leading the charge in this market, with a mix of local and international players competing for market share. The presence of firms such as FTI Consulting highlights the competitive landscape, as they offer tailored solutions to meet the specific needs of businesses facing financial distress. As the region continues to evolve, the demand for specialized consulting services is expected to rise significantly.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa region is gradually emerging in the Bankruptcy and Insolvency Consulting Services market, with a market size of 1.0 in 2024. Economic diversification efforts and increasing corporate bankruptcies are driving demand for consulting services. Regulatory bodies are beginning to implement frameworks that support effective insolvency processes, which is crucial for fostering business confidence and attracting foreign investment.

Countries such as South Africa and the UAE are leading the way in this evolving market, with a growing number of consulting firms entering the space. The competitive landscape is characterized by both local and international players, each striving to establish a foothold in this untapped market. As the region continues to develop, the demand for specialized consulting services is expected to grow, presenting significant opportunities for firms willing to invest in this area.