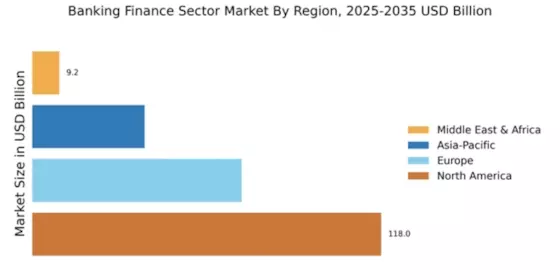

North America : Market Leader in Banking Finance

North America continues to lead the Banking Finance Sector, holding a market size of $117.95B in 2025. Key growth drivers include technological advancements, regulatory support, and a robust consumer base. The region's financial institutions are increasingly adopting digital solutions, enhancing customer experience and operational efficiency. Regulatory frameworks are also evolving to support innovation while ensuring stability, contributing to a favorable market environment. The competitive landscape is dominated by major players such as JPMorgan Chase, Bank of America, and Wells Fargo, which are leveraging their extensive networks and resources. The presence of these institutions fosters a competitive yet stable market, with a focus on customer-centric services. As the largest market, North America is expected to maintain its position, driven by continuous investment in technology and customer engagement strategies.

Europe : Regulatory Frameworks Drive Growth

Europe's Banking Finance Sector is characterized by a market size of $70.77B in 2025, driven by regulatory reforms and a shift towards digital banking. The European Central Bank's initiatives to enhance financial stability and promote innovation are pivotal in shaping the market. Demand for sustainable finance is also on the rise, with regulations encouraging green investments and responsible banking practices, thus fostering growth in this sector. Leading countries such as Germany, France, and the UK are home to significant players like Deutsche Bank, BNP Paribas, and HSBC. The competitive landscape is marked by a mix of traditional banks and fintech companies, creating a dynamic environment. The focus on digital transformation and customer-centric services is reshaping the banking experience, positioning Europe as a key player in the global market.

Asia-Pacific : Emerging Markets on the Rise

The Asia-Pacific region, with a market size of $38.0B in 2025, is witnessing rapid growth in the Banking Finance Sector. Key drivers include increasing urbanization, rising disposable incomes, and a growing middle class, which are fueling demand for banking services. Additionally, government initiatives aimed at financial inclusion and digital banking are catalyzing market expansion, making it a focal point for investment and innovation. Countries like China, India, and Japan are leading the charge, with major players such as HSBC and local banks expanding their services. The competitive landscape is evolving, with fintech companies emerging as significant challengers to traditional banks. This dynamic environment is fostering innovation and enhancing customer experiences, positioning the Asia-Pacific region as a burgeoning market in the global banking landscape.

Middle East and Africa : Untapped Potential in Banking

The Middle East and Africa region, with a market size of $9.17B in 2025, presents significant growth opportunities in the Banking Finance Sector. Key drivers include increasing investment in infrastructure, a young population, and a growing demand for financial services. Governments are actively promoting financial inclusion and digital banking initiatives, which are expected to enhance access to banking services across the region. Leading countries such as South Africa, Nigeria, and the UAE are witnessing a surge in banking activities, with both local and international players expanding their footprint. The competitive landscape is characterized by a mix of traditional banks and emerging fintech solutions, which are reshaping the banking experience. As the region continues to develop, it is poised for substantial growth, attracting investments and fostering innovation.