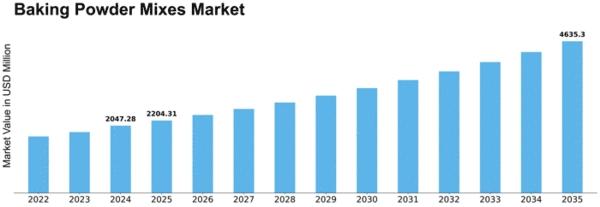

Baking Powder Mixes Size

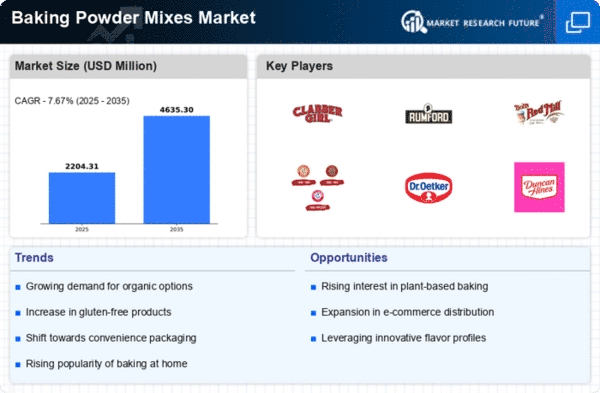

Baking Powder Mixes Market Growth Projections and Opportunities

Several market factors influence the dynamics of the Baking Powders and Mixes market and shape its growth, trends, and consumer preferences. One decisive factor is the evolving nutritional landscape, where more and more consumers follow special diets such as gluten-free, vegan and allergen-free. In response to these dietary trends, manufacturers in the baking powder and mix market are developing products that meet these specific needs and offer options that allow people with dietary restrictions to enjoy homemade baked goods. The demand for products that meet different dietary preferences influences the product development and market position of bread mixes. The wider health and wellness movement is having a major impact on the baking powder and mix market. Consumers are increasingly aware of the impact of their food choices on overall health, leading to a shift towards healthier and more nutritious alternatives. Manufacturers are responding by adding natural and organic ingredients, reducing sugar content and avoiding artificial additives in their baking mixes. The emphasis on health-conscious options is fueling the growth of a market segment dedicated to providing nutritious, better-for-you baking options. The convenience factor plays a key role in shaping the market for baking powder and mixes. In a fast-paced world where time is often limited, consumers are looking for convenient solutions that simplify the cooking process without sacrificing taste. With simplified instructions and easy-to-use ingredients, prepackaged baking mixes meet the demand for an easy baking experience. Convenience is an important factor for those who want to enjoy homemade baked goods without the time-consuming preparation and measuring associated with traditional baking. The plant-based movement has gained momentum in various food categories, and the baking powder and mix market is no exception. As more and more consumers adopt a plant-based diet, the demand for baking mixes that do not contain animal products is increasing. Manufacturers have responded to vegetarian and vegan preferences by developing plant-based and vegan baking mixes. This trend reflects a broader shift towards sustainable and plant-based eating habits.

Leave a Comment