Market Analysis

In-depth Analysis of Bacteriostatic Water for Injection Market Industry Landscape

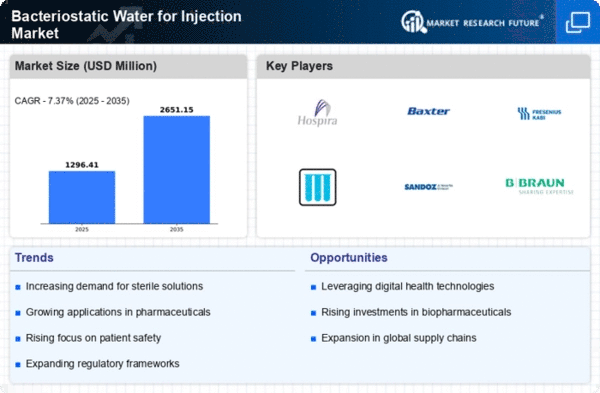

The market dynamics of bacteriostatic water for injection (BWI) underscore a critical component in the healthcare and pharmaceutical sectors, playing a key role in diluting and preparing medications. The demand for bacteriostatic water has been steadily rising due to its essential application in reconstituting drugs for injection, particularly in settings such as hospitals, clinics, and research laboratories. The market is propelled by the increasing prevalence of various medical conditions that require intravenous medications, driving the need for a reliable and sterile diluent.

One of the primary factors contributing to the growth of the bacteriostatic water for injection market is the expanding pharmaceutical industry. As pharmaceutical companies continue to develop and manufacture a wide range of injectable medications, the demand for bacteriostatic water as a diluent has surged. This includes applications in the production of vaccines, antibiotics, and other injectable drugs where maintaining sterility is paramount. The versatility of bacteriostatic water in aiding drug reconstitution positions it as a crucial element in pharmaceutical manufacturing processes.

The healthcare sector's increasing focus on patient safety has also fueled the demand for bacteriostatic water for injection. The unique characteristic of bacteriostatic water, which inhibits the growth of bacteria in the solution, adds an extra layer of safety to intravenous medications. This is particularly important in preventing infections associated with the administration of injectable drugs. As healthcare providers prioritize patient well-being, the adoption of bacteriostatic water as a diluent is likely to continue to rise.

Furthermore, the market dynamics are influenced by the growing prevalence of chronic diseases, which often require long-term intravenous treatments. Conditions such as diabetes, autoimmune disorders, and certain cancers necessitate regular injections of medications. Bacteriostatic water, with its ability to maintain sterility even after repeated withdrawals from a vial, becomes indispensable in such therapeutic scenarios. The convenience and reliability offered by bacteriostatic water contribute to its widespread adoption in the healthcare landscape.

The competitive landscape of the bacteriostatic water for injection market is characterized by the presence of established pharmaceutical companies and suppliers specializing in sterile water products. As the demand for bacteriostatic water continues to rise, there is a notable focus on product differentiation and quality assurance among manufacturers. Companies are investing in research and development to enhance the purity and stability of bacteriostatic water, meeting the stringent requirements of the pharmaceutical and healthcare industries.

Despite the positive market outlook, challenges such as regulatory compliance and stringent quality control standards pose considerations for market players. The need for adherence to pharmacopeial standards and regulatory guidelines underscores the importance of maintaining product integrity and safety. Manufacturers must navigate these regulatory landscapes to ensure their bacteriostatic water products meet the required quality standards, ensuring trust and reliability among end-users.

Leave a Comment