Market Trends

Key Emerging Trends in the Bacteriostatic Water for Injection Market

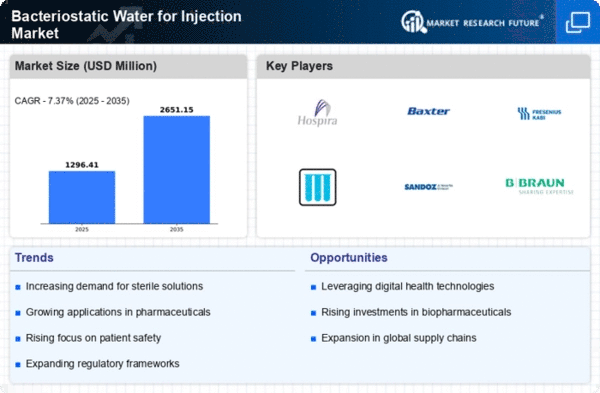

The market trends of bacteriostatic water for injection (BWI) have undergone notable developments, influenced by various factors that cater to the pharmaceutical and healthcare sectors. Bacteriostatic water is a key component used in reconstituting medications for injection and is known for inhibiting the growth of bacteria in the solution. One prominent trend in the BWI market is the increasing demand for injectable medications across various medical applications. With the rise in chronic diseases and the development of novel therapeutic solutions, the need for bacteriostatic water for injection has surged, driving market growth.

The pharmaceutical industry's inclination towards biologics and biosimilars has also impacted the bacteriostatic water for injection market. Biopharmaceuticals often require precise reconstitution to maintain their stability and efficacy. Bacteriostatic water serves as a reliable medium for dilution, ensuring the safety and integrity of these complex therapeutic agents. As the biopharmaceutical sector continues to expand, the demand for bacteriostatic water for injection is expected to grow in tandem, reflecting a significant market trend.

Another notable trend is the emphasis on product innovation and the development of advanced packaging solutions. Manufacturers in the BWI market are investing in research and development to enhance the safety and convenience of their products. Innovations include user-friendly vials, pre-filled syringes, and advanced packaging materials that contribute to easier handling and administration of medications. These developments align with the industry's focus on patient-centric solutions and are likely to influence purchasing decisions, fostering market growth.

Stringent regulatory requirements and quality standards have become pivotal factors shaping the bacteriostatic water for injection market trends. Compliance with regulatory guidelines, particularly in pharmaceutical manufacturing, is crucial for ensuring product safety and efficacy. Manufacturers are investing in quality assurance measures, such as Good Manufacturing Practices (GMP), to meet these standards. This focus on adherence to regulatory requirements contributes to building trust among consumers and stakeholders, positively impacting the market.

The growing awareness of infectious diseases and the importance of safe injection practices have propelled the demand for bacteriostatic water for injection in healthcare settings. With an increased emphasis on preventing healthcare-associated infections, healthcare professionals are seeking reliable and sterile solutions for medication preparation. Bacteriostatic water's ability to prevent bacterial growth in reconstituted medications aligns with these safety objectives, making it a preferred choice in healthcare facilities and contributing to market expansion.

Cost-effectiveness is another significant factor influencing market trends in the bacteriostatic water for injection market. As healthcare systems strive to optimize operational costs, there is a growing preference for affordable yet high-quality solutions. Manufacturers are responding to this trend by offering competitively priced bacteriostatic water for injection without compromising on product quality. This affordability factor is contributing to the widespread adoption of bacteriostatic water, especially in settings where cost considerations play a crucial role in decision-making.

Leave a Comment