Advancements in Healthcare Policies

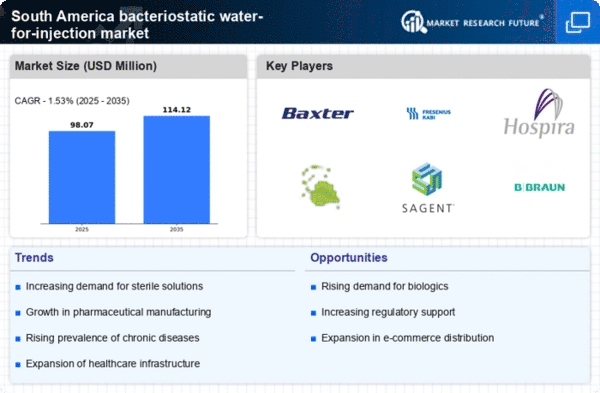

Advancements in healthcare policies across South America are influencing the bacteriostatic water-for-injection market. Governments are increasingly focusing on improving healthcare access and quality, which includes the regulation of pharmaceutical products. Recent policy changes aim to streamline the approval processes for injectable medications, thereby enhancing market dynamics. For instance, Brazil's National Health Surveillance Agency has implemented new guidelines that facilitate faster market entry for essential drugs, including those requiring bacteriostatic water for preparation. This regulatory environment encourages innovation and investment in the pharmaceutical sector, potentially leading to a 10% increase in the demand for bacteriostatic water in the coming years as more injectable products become available.

Rising Incidence of Chronic Diseases

The rising incidence of chronic diseases in South America is a critical driver for the bacteriostatic water-for-injection market. Conditions such as diabetes, cardiovascular diseases, and cancer are becoming increasingly prevalent, necessitating effective treatment options that often include injectable therapies. The World Health Organization has reported a steady increase in chronic disease cases, with projections indicating that by 2030, chronic diseases will account for over 70% of all deaths in the region. This alarming trend underscores the need for reliable bacteriostatic water, which is essential for the preparation of injectable medications. As healthcare systems adapt to address these challenges, the demand for bacteriostatic water is expected to rise, further propelling market growth.

Expansion of Pharmaceutical Manufacturing

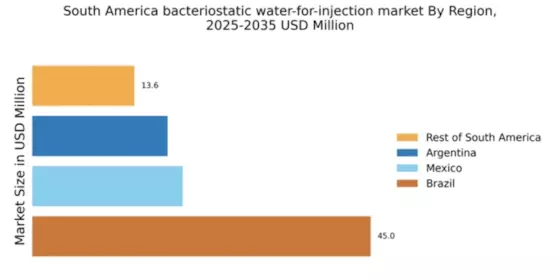

The expansion of pharmaceutical manufacturing facilities in South America significantly impacts the bacteriostatic water-for-injection market. As local manufacturers ramp up production to meet both domestic and international demand, the need for high-quality excipients, including bacteriostatic water, becomes paramount. Countries like Brazil and Argentina are witnessing substantial investments in their pharmaceutical sectors, with an estimated increase in production capacity by 15% over the next few years. This expansion not only boosts the availability of injectable medications but also necessitates a reliable supply of bacteriostatic water, thereby driving market growth. Furthermore, the establishment of stringent quality control measures in manufacturing processes enhances the demand for bacteriostatic water, ensuring that products meet regulatory standards.

Increasing Demand for Injectable Medications

The rising demand for injectable medications in South America is a primary driver for the bacteriostatic water-for-injection market. As healthcare providers increasingly prefer injectable formulations for their rapid onset of action and higher bioavailability, the need for bacteriostatic water has surged. This trend is particularly evident in therapeutic areas such as oncology and diabetes management, where injectable drugs are essential. According to recent estimates, the injectable drug market in South America is projected to grow at a CAGR of approximately 8% over the next five years. This growth directly correlates with the increasing utilization of bacteriostatic water, which is crucial for diluting and reconstituting these medications, thereby enhancing the overall market landscape.

Growing Awareness of Safe Injection Practices

Growing awareness of safe injection practices among healthcare professionals and patients is a significant driver for the bacteriostatic water-for-injection market. Educational initiatives and training programs are being implemented to promote the importance of using sterile and safe practices when administering injectable medications. This heightened awareness is crucial in preventing infections and ensuring patient safety, which in turn drives the demand for bacteriostatic water. As healthcare facilities adopt stricter protocols and guidelines, the need for high-quality bacteriostatic water is likely to increase. Reports suggest that adherence to safe injection practices could lead to a 20% rise in the consumption of bacteriostatic water in South America, reflecting the growing emphasis on patient safety and quality care.