Rising Demand in Water Management

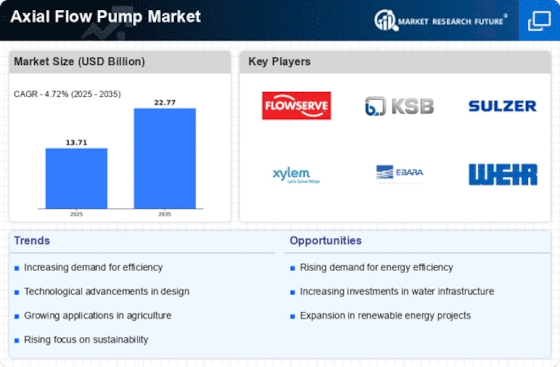

The Axial Flow Pump Market is experiencing a notable increase in demand due to the growing need for efficient water management systems. As urbanization accelerates, the pressure on water resources intensifies, necessitating advanced pumping solutions. Axial flow pumps, known for their high flow rates and energy efficiency, are becoming essential in applications such as irrigation, drainage, and wastewater treatment. According to recent data, the market for axial flow pumps is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years. This trend indicates a robust expansion in the industry, driven by the need for sustainable water management practices and the implementation of modern infrastructure to support population growth.

Increased Focus on Renewable Energy

The Axial Flow Pump Market is poised to benefit from the growing emphasis on renewable energy sources. As countries strive to reduce their carbon footprints, there is a shift towards sustainable energy solutions, including hydropower. Axial flow pumps play a crucial role in hydropower plants, facilitating the movement of water to generate electricity. The increasing number of hydropower projects worldwide is likely to drive demand for axial flow pumps, as they are well-suited for high-flow, low-head applications. Market analysts predict that the integration of axial flow pumps in renewable energy projects will contribute to a significant portion of the industry's growth, aligning with global sustainability goals.

Technological Innovations in Pump Design

The Axial Flow Pump Market is witnessing a wave of technological innovations that enhance pump performance and reliability. Advances in materials science and engineering have led to the development of more durable and efficient axial flow pumps. These innovations not only improve the lifespan of the pumps but also reduce maintenance costs, making them more attractive to end-users. The introduction of smart technologies, such as IoT-enabled monitoring systems, allows for real-time performance tracking and predictive maintenance, further driving the adoption of axial flow pumps across various sectors. As these technologies continue to evolve, they are expected to play a pivotal role in shaping the future of the axial flow pump market.

Industrial Growth and Process Optimization

The Axial Flow Pump Market is significantly influenced by the expansion of various industrial sectors, including chemical processing, power generation, and oil and gas. Industries are increasingly adopting axial flow pumps to optimize their processes, as these pumps offer advantages such as lower energy consumption and higher efficiency in transporting fluids. The demand for axial flow pumps is expected to rise as industries seek to enhance productivity while minimizing operational costs. Recent statistics suggest that the industrial sector accounts for a substantial share of the axial flow pump market, with projections indicating a steady growth trajectory as companies invest in modernizing their equipment and processes.

Regulatory Support for Water Infrastructure

The Axial Flow Pump Market is benefiting from increased regulatory support aimed at improving water infrastructure. Governments are recognizing the importance of modernizing water systems to ensure efficient distribution and management of water resources. This has led to the implementation of policies and funding initiatives that promote the adoption of advanced pumping technologies, including axial flow pumps. As regulations become more stringent regarding water quality and efficiency, the demand for reliable and efficient pumping solutions is likely to rise. The alignment of regulatory frameworks with industry needs suggests a favorable environment for the growth of the axial flow pump market, as stakeholders seek to comply with new standards.