Market Growth Projections

The Global Aviation Services Market Industry is projected to experience robust growth over the next decade. With a market value of 235.94 USD Billion in 2024, the industry is expected to expand significantly, reaching 541.32 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate (CAGR) of 7.84% from 2025 to 2035. Such projections underscore the increasing importance of aviation services in the global economy, driven by factors such as rising air travel demand, technological advancements, and the expansion of services in emerging markets.

Sustainability Initiatives

Sustainability has emerged as a critical driver within the Global Aviation Services Market Industry. Airlines and service providers are increasingly adopting eco-friendly practices to reduce their carbon footprint and meet regulatory requirements. Initiatives such as the use of sustainable aviation fuels and the implementation of carbon offset programs are gaining traction. This shift towards sustainability not only addresses environmental concerns but also appeals to environmentally conscious consumers. As the industry evolves, the emphasis on sustainable practices is likely to play a significant role in shaping market dynamics and attracting investment.

Technological Advancements

Technological innovations are playing a pivotal role in shaping the Global Aviation Services Market Industry. Advancements in aircraft design, fuel efficiency, and digital technologies are enhancing operational efficiency and passenger experience. For instance, the integration of artificial intelligence and data analytics is streamlining airline operations and improving customer service. These innovations not only reduce operational costs but also contribute to sustainability efforts, which are becoming increasingly important in the aviation sector. As the industry embraces these technologies, it is likely to see a significant boost in market growth, aligning with the projected CAGR of 7.84% from 2025 to 2035.

Increasing Air Travel Demand

The Global Aviation Services Market Industry is experiencing a notable surge in air travel demand, driven by rising disposable incomes and a growing middle class in emerging economies. As more individuals opt for air travel, airlines are expanding their fleets and enhancing service offerings. This trend is expected to contribute to the market's growth, with projections indicating a market value of 235.94 USD Billion in 2024. The increasing frequency of business and leisure travel is likely to further stimulate demand for aviation services, thereby fostering a robust environment for industry players.

Market Expansion in Emerging Economies

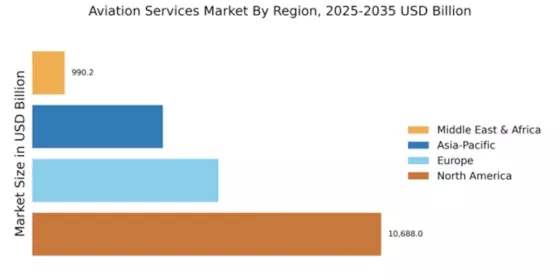

The Global Aviation Services Market Industry is witnessing substantial growth in emerging economies, where urbanization and economic development are driving air travel demand. Countries in Asia-Pacific and Africa are experiencing rapid infrastructure development, leading to the establishment of new airports and expansion of existing ones. This growth is expected to facilitate increased connectivity and accessibility, further stimulating the aviation services market. By 2035, the market is projected to reach 541.32 USD Billion, reflecting the potential of these regions to contribute significantly to the global aviation landscape.

Regulatory Support and Safety Standards

The Global Aviation Services Market Industry benefits from stringent regulatory frameworks that prioritize safety and security in air travel. Governments worldwide are implementing policies that enhance safety standards and promote the adoption of best practices among airlines and service providers. This regulatory support fosters consumer confidence, encouraging more individuals to choose air travel. Furthermore, compliance with international safety regulations can lead to operational efficiencies, ultimately benefiting the bottom line for aviation service providers. As the industry continues to adapt to evolving regulations, it is poised for sustained growth in the coming years.