Aviation Fuel Size

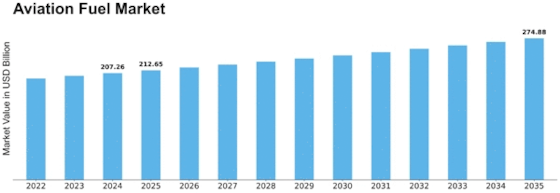

Aviation Fuel Market Growth Projections and Opportunities

The Aviation Fuel Market is a complex environment that is influenced by evolving dynamics representing the intricate balance between aviation industry requirements, trends in energy globally and environmental concerns. The demand for aviation fuel is one of the key dynamics closely tied to the growth of the aviation sector. The increasing global air travel volumes, particularly in emerging economies, correspondingly influence the demand for aviation fuels. This dynamic is driven by factors such as growth in passenger numbers, fleet expansion, as well as persistent internationalization of trade and tourism.

Geopolitical events and global economic conditions have tremendous implications on market dynamics in Aviation Fuel Market. For example, oil prices that directly affect the cost of aviation fuel are susceptible to geopolitical tensions, supply disruptions and economic uncertainties. As a result, it increases the chances of occurrence of these political risks which can change abruptly thus changing fuel costs leading to an increase in operational costs for airlines and problems for suppliers of fuel. Therefore, given these geopolitical challenges faced by different market participants it becomes imperative to maintain stability within this industry so that its performance does not become unpredictable.

Technological advancements within the aviation sector are critical drivers of market dynamics. The industry consistently seeks more efficient airplanes which include alternative propulsion systems as part of efforts towards sustainability that minimizes environmental impacts. The desire for advanced aircrafts, engines or aerodynamic technologies will impact upon the kind of “green” aviation fuels required due to their efficiency and friendliness to the ecosystem respectively. In effect this brings out another crucial aspect in shaping up this petroleum subsector through propagation of innovative strategies aimed at reducing wastage while improving on efficiency.

In particular environmental considerations concerning sustainability are transformational dynamics within Aviation Fuel Market’s spacescape . In responding to increasing pressure on greenhouse gas emissions reduction which triggers adoption of sustainable aviation fuels (SAFs) and biofuels; corporate responsibility goals combined with consumer preferences for green air travels have necessitated new legislation changes being made regarding alternative and sustainable sources. This is driven by policies, corporate responsibility goals and consumer inclination for environmental friendly air travels. The push towards alternative and sustainable aviation fuels shows the commitment of this industry in addressing ecological concerns while joining efforts to combat climate change globally.

Given the global nature of the industry, supply chain dynamics are pivotal to Aviation Fuel Market. Supplying aviation fuel involves several intricate logistics such as refinery capacities; transportation infrastructure; and geopolitical factors affecting it. When any disruption occurs in the process of supplying fuel due to natural calamities or other unforeseen events that result into political disputes, it leads to immediate and enduring impacts on market prices . It is vital for market players to know how they can adjust their activities so that there should be a constant supply of fuel used in aviation.

The Aviation Fuel Market’s dynamics are shaped by government regulations along with international agreements. These governing rules such as emission standards or incentives aimed at using green aviation petrol have a direct effect on fuel sourcing practices within this field. International agreements like CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation) help guide the industry towards reducing its carbon footprint. Thus, these compliance requirements underpinning these regulations and agreement become catalysts driving the growth of this sector over time”

Volatility of oil prices also influences market forces. The cost structure of the aviation fuel market is affected directly by changes in oil prices, given that petroleum oil is the main source of aviation fuel. OPEC decisions, geopolitical events and global economic conditions all contribute to these price variations. Understandably, it is important for airlines, stakeholders and other fuel suppliers to handle this dynamism to be able to navigate through markets effectively.

Market dynamics are shaped by competition among producers and suppliers of aviation fuels. As airlines seek sources of fuel that are both reliable and cheap, suppliers aim at providing competitive pricing, efficiency in their supply chains as well as innovative solutions. This includes oil companies, independent refiners, biofuel manufacturers; they all come up with strategies that impact on market trends. Therefore participants in Aviation Fuel Market have to adapt to changing market scenarios and meet emerging demands from airlines.

Technological advancements in the production processes for fuels affect the dynamics behind marketing aviation fuels. These developments affect market processes such as refining technologies utilized which lead to creation of efficient conversion processes for sustainable aviation fuels or even new ways biofuels can be made . These innovations determine whether airlines will adopt certain strategies or alternative options with regard to fuel use.

To sum up the Aviation Fuel Market is influenced by dynamic forces arising from growth in the airline industry; geopolitical events; technological advancement; environmental concerns; Supply chain dynamics; Government regulations; Oil price volatility; Competitive landscape; Technological innovation (Ad). As these dynamics interact with others within a continually changing context, they create opportunities as well as challenges that reframe what could happen next within the Aviation Fuel Market’s future trajectory.

Leave a Comment