North America : Market Leader in Aviation Services

North America is poised to maintain its leadership in the Aviation Component Repair and Optimization Services Market, holding a significant market share of 5.75 in 2024. The region benefits from a robust aerospace industry, driven by increasing air travel demand and stringent safety regulations. Government initiatives aimed at enhancing aviation infrastructure further catalyze market growth, ensuring compliance with evolving standards.

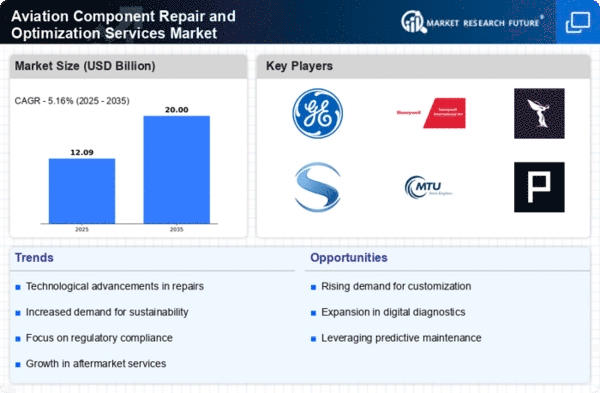

The competitive landscape is characterized by major players such as General Electric, Honeywell International, and Pratt & Whitney, which dominate the market. The U.S. remains the leading country, supported by advanced technology and a skilled workforce. The presence of key players fosters innovation and efficiency, positioning North America as a hub for aviation services.

Europe : Emerging Market with Growth Potential

Europe, with a market size of 3.0, is witnessing a surge in demand for Aviation Component Repair and Optimization Services. The region's growth is driven by increasing air traffic and a focus on sustainability, prompting airlines to optimize their operations. Regulatory frameworks, such as the European Union Aviation Safety Agency (EASA) guidelines, are pivotal in shaping industry standards and ensuring safety compliance, thus fostering market expansion.

Leading countries like Germany, France, and the UK are at the forefront of this market, with key players such as Rolls-Royce and Safran driving innovation. The competitive landscape is marked by collaborations and partnerships aimed at enhancing service offerings. The presence of established companies ensures a robust supply chain, further solidifying Europe's position in the global market.

Asia-Pacific : Rapidly Growing Aviation Sector

Asia-Pacific is emerging as a significant player in the Aviation Component Repair and Optimization Services Market, with a market size of 2.5. The region's growth is fueled by rising disposable incomes, increasing air travel, and expanding airline fleets. Governments are investing in aviation infrastructure, which is crucial for meeting the growing demand and enhancing service capabilities in the sector.

Countries like China and India are leading the charge, with a burgeoning number of airlines and a focus on modernizing fleets. The competitive landscape includes both local and international players, creating a dynamic environment for service innovation. The presence of key companies such as MTU Aero Engines and Boeing further strengthens the region's market position, driving advancements in repair and optimization services.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa region, with a market size of 0.25, is gradually emerging in the Aviation Component Repair and Optimization Services Market. The growth is primarily driven by increasing air travel demand and investments in aviation infrastructure. Countries in the Middle East are focusing on becoming global aviation hubs, which is expected to enhance service offerings and attract international airlines.

Leading countries like the UAE and South Africa are making significant strides in developing their aviation sectors. The competitive landscape is characterized by a mix of local and international players, with companies like Lufthansa Technik establishing a presence. As the region continues to invest in aviation, the potential for growth in repair and optimization services remains substantial.