North America : Market Leader in Aviation Fuel Systems

North America is poised to maintain its leadership in the Aviation Fuel System Maintenance and Repair Market, holding a significant market share of 3.75 in 2024. The region's growth is driven by increasing air travel demand, stringent safety regulations, and advancements in fuel efficiency technologies. Regulatory bodies are emphasizing compliance with safety standards, further propelling market growth.

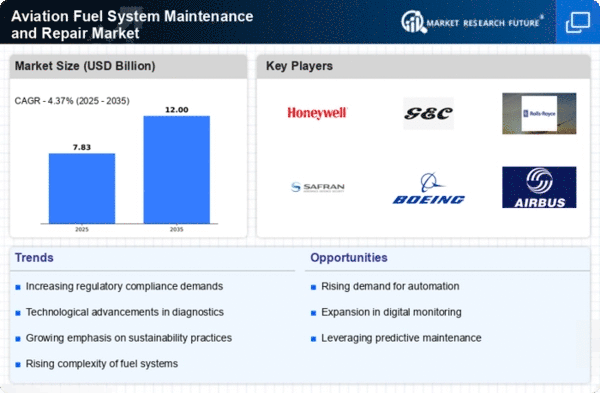

The competitive landscape is robust, with key players like Honeywell International Inc, General Electric Company, and Boeing Company leading the charge. The U.S. is the primary market, supported by a well-established aviation infrastructure and a high volume of aircraft operations. This concentration of industry leaders fosters innovation and enhances service offerings, ensuring North America's continued dominance in the sector.

Europe : Emerging Market with Growth Potential

Europe's Aviation Fuel System Maintenance and Repair Market is on an upward trajectory, with a market size of 2.25 in 2024. The region benefits from increasing investments in aviation infrastructure and a growing emphasis on sustainable aviation practices. Regulatory frameworks are evolving to support greener technologies, which is expected to drive demand for maintenance services.

Leading countries such as Germany, France, and the UK are at the forefront of this growth, hosting major players like Rolls-Royce Holdings and Safran S.A. The competitive landscape is characterized by strategic partnerships and technological advancements, positioning Europe as a key player in the global market. The European Union's commitment to reducing carbon emissions is also a significant catalyst for market expansion.

Asia-Pacific : Rapidly Growing Aviation Sector

The Asia-Pacific region is witnessing rapid growth in the Aviation Fuel System Maintenance and Repair Market, with a market size of 1.5 in 2024. This growth is fueled by increasing air travel demand, expanding airline fleets, and government initiatives to enhance aviation infrastructure. Regulatory support for safety and efficiency is also a key driver, as countries aim to modernize their aviation sectors.

Countries like China, India, and Japan are leading the charge, with significant investments in aviation technology and maintenance services. The competitive landscape includes major players such as Woodward, Inc. and Parker Hannifin Corporation, who are focusing on innovation and service quality to capture market share. The region's dynamic growth presents numerous opportunities for stakeholders in the aviation fuel system sector.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa region is gradually emerging in the Aviation Fuel System Maintenance and Repair Market, with a market size of 0.75 in 2024. The growth is driven by increasing air travel, investments in airport infrastructure, and a rising number of airlines. However, challenges such as regulatory hurdles and geopolitical instability can impact market dynamics.

Countries like the UAE and South Africa are leading the market, with significant investments in aviation technology and maintenance services. The presence of key players like Eaton Corporation and local firms is enhancing competition. As the region continues to develop its aviation capabilities, the demand for maintenance and repair services is expected to rise, presenting opportunities for growth.