Market Share

Aviation Analytics Market Share Analysis

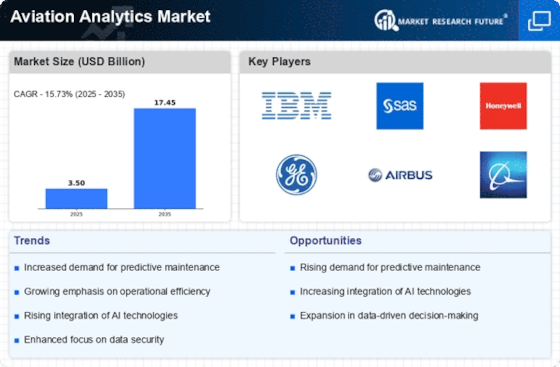

The Aviation Analytics market is currently having tremendous dynamics that echo the industry’s quest for data driven insights and operational efficiency. One of the key trends is an increasing use of predictive analytics in aviation operations. Predictive maintenance, flight schedule optimization, and equipment failure prediction are among the areas where airlines, airports and maintenance organizations are using advanced analytics to forecast maintenance needs. The motivation behind this industry adoption of predictive analytics is to improve operational efficiency, minimize downtime and enhance safety by making proactive decisions based on predictive insights.

Another notable trend is incorporating artificial intelligence (AI) and machine learning (ML) into aviation analytics. These techniques are employed for analyzing huge datasets, identifying trends and suggesting actionable conclusions. Hence these include artificial intelligence or machine learning applications in aviation analytics such as; demand forecasting, route optimization, enhancing customer experience and predictive maintenance. This indicates that the industry has moved towards smarter adaptive analytical solutions embracing innovation as well as effectiveness over different sections of the aviation ecosystem.

It is gaining moment to boost passenger experience through analytics. Airlines use consumer data to personalize services, optimize in-flight experiences, and adjust prices appropriately. It uses statistics to understand what passengers want amongst themselves when they want it most or how they would like it served during travel time so that customers can get their snacks better prepared or served upon a request right from their seats at any particular time since new business models emerged which changed all relationships between air companies’ passengers’ flights . In line with this focus on improving overall travelling experiences for modern-day tech-savvy clientele with insights generated through data 4 driven strategies , it perfectly confirms this trend.

Additionally, there is a trend in applying analytics to aircraft operations aimed at environmental sustainability by aviation organizations which focuses on fuel efficiency. Optimizing flight routes are being done via analysis enabling airlines reduce consumption of fuel while minimizing carbon footprints emitted during flights they take off their planes . This implies that the sector recognizes its responsibility towards nature and supports efforts to reduce global impact of its operations on climate change. Such initiatives are based on analytics for sustainable practices that make aviation greener and more efficient.

The fusion of Internet of Things (IoT) devices with aviation analytics is also a telling trend in the future of aircraft monitoring and maintenance. IoT sensors are embedded in various airplane parts to provide real-time information about equipment performance, fuel efficiency and other crucial parameters. Aviation analytics then processes this data which allows for predictive maintenance hence cutting down on unplanned downtime.. This specific development indicates the industry’s strive towards a connected, data-driven air travel system which optimizes operational visibility and efficiency through reliance on IoT.

Moreover, cybersecurity is emerging as a critical trend in the Aviation Analytics market. The airline industry increasingly relies on interconnections between systems as well as sharing of data for analytical purposes prompting the need to protect sensitive information against unauthorized access. This has led aviation organizations to invest heavily in cyber security so that they can protect their analytic systems from cyber threats which can disrupt the current integrity their industry enjoys. Securing stakeholder trust is essential while ensuring secureness of data within analysis methods because it holds critical aviation knowledge

Furthermore, there has been an attempt by different aviation firms to democratize analytics by targeting wider range of users/employees involved in operations management. These include simple to use tools and platforms that have been developed with non-technical persons or staff members at airlines’ disposal for accessing data driven insights out there . In essence, there is a trend towards increased involvement among stakeholders thus enabling them at any place along the value chain (e.g., airports) to leverage analytics rapidly using informed decision making.

Leave a Comment