Automotive Wiring Harness Size

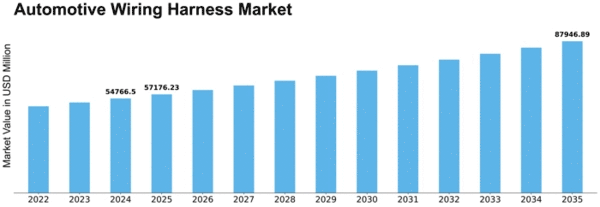

Automotive Wiring Harness Market Growth Projections and Opportunities

The automotive wiring harness industry is influenced by various market factors that shape its dynamics and growth trajectory. One primary factor is the continuous evolution of vehicle electronics and electrical systems. As automobiles become more technologically advanced, with features such as advanced driver assistance systems (ADAS), infotainment systems, and electrified powertrains, the complexity and demand for wiring harnesses increase. These harnesses serve as the nervous system of the vehicle, transmitting power and data to various components, sensors, and modules. Consequently, automakers and wiring harness manufacturers must adapt to accommodate the evolving requirements of modern vehicles, driving innovation and advancements in wiring harness technology.

Regulatory standards and compliance requirements also significantly impact the automotive wiring harness market. Governments around the world enforce regulations related to vehicle safety, emissions, and electrical systems. Compliance with these standards is essential for ensuring the safety, reliability, and performance of vehicles. As regulations evolve and become more stringent, automakers and wiring harness manufacturers must invest in research, development, and testing to meet and exceed regulatory requirements. Failure to comply with these standards can result in significant financial penalties, damage to brand reputation, and legal repercussions, making regulatory compliance a critical factor in the automotive wiring harness industry.

Technological advancements and innovation play a crucial role in shaping the market factors of automotive wiring harnesses. With the automotive industry undergoing a rapid transformation towards electrification, connectivity, and autonomous driving, wiring harnesses must keep pace with these technological changes. For instance, the rise of electric vehicles (EVs) requires wiring harnesses capable of managing high-voltage systems and battery packs. Similarly, the integration of connectivity features and advanced driver assistance systems necessitates wiring harnesses that can support complex communication networks and sensor arrays. As a result, wiring harness manufacturers must invest in research and development to develop new materials, designs, and manufacturing processes that can meet the demands of emerging automotive technologies.

Market demand and consumer preferences also influence the factors driving the automotive wiring harness industry. As consumers increasingly prioritize safety, comfort, convenience, and environmental sustainability in their vehicles, automakers must incorporate advanced features and technologies into their vehicles. This includes features such as adaptive cruise control, lane-keeping assistance, smartphone integration, and electrified powertrains. Wiring harnesses play a critical role in enabling these features, making them an essential component of modern vehicles. As consumer expectations evolve, automakers and wiring harness manufacturers must innovate and adapt to meet these changing demands, driving market dynamics and influencing the development of wiring harness technologies.

Global economic factors, such as raw material prices, labor costs, and currency fluctuations, also impact the automotive wiring harness market. Fluctuations in commodity prices, particularly copper and other metals used in wiring harness manufacturing, can affect production costs and profit margins for manufacturers. Additionally, shifts in labor costs and availability of skilled workforce in different regions can influence manufacturing decisions and supply chain strategies. Currency fluctuations and trade policies may also impact the competitiveness of wiring harness manufacturers operating in global markets. As a result, companies must carefully monitor and manage these economic factors to remain competitive and sustainable in the automotive wiring harness industry.

The automotive wiring harness industry is influenced by a complex interplay of market factors, including technological advancements, regulatory standards, consumer preferences, and global economic conditions. As the automotive industry continues to evolve and innovate, wiring harness manufacturers must adapt to meet the evolving needs and demands of automakers and consumers. By staying abreast of market trends, investing in research and development, and maintaining a focus on quality, reliability, and compliance, wiring harness manufacturers can position themselves for success in a rapidly changing and competitive automotive landscape

Leave a Comment