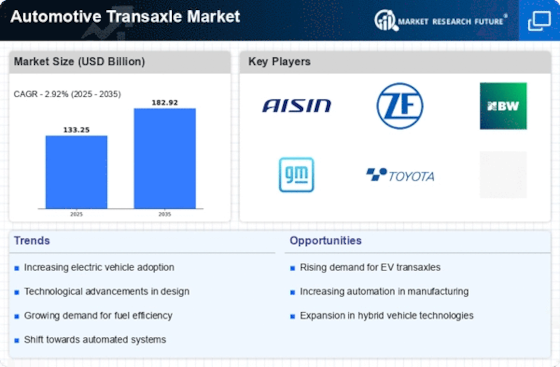

Rising Demand for Fuel Efficiency

The Automotive Transaxle Market is experiencing a notable surge in demand for fuel-efficient vehicles. As consumers become increasingly conscious of fuel costs and environmental impacts, manufacturers are compelled to innovate. The integration of advanced transaxle systems plays a crucial role in enhancing fuel efficiency. According to recent data, vehicles equipped with modern transaxles can achieve up to 20% better fuel economy compared to older models. This trend is likely to drive investments in research and development, as automakers strive to meet consumer expectations while adhering to stringent emissions regulations. Consequently, the Automotive Transaxle Market is poised for growth as it aligns with the global shift towards sustainability and efficiency.

Growth of Electric and Hybrid Vehicles

The Automotive Transaxle Market is significantly influenced by the rapid growth of electric and hybrid vehicles. As the automotive landscape evolves, manufacturers are increasingly adopting transaxle systems designed specifically for electric powertrains. These systems facilitate efficient power distribution and enhance vehicle performance. Recent statistics indicate that electric vehicle sales have surged, with projections suggesting that they could account for over 30% of total vehicle sales by 2030. This shift necessitates the development of specialized transaxles that can handle the unique requirements of electric and hybrid vehicles. Thus, the Automotive Transaxle Market is likely to expand as it adapts to these emerging technologies.

Increasing Focus on Autonomous Vehicles

The Automotive Transaxle Market is also being driven by the increasing focus on autonomous vehicles. As the automotive sector moves towards automation, the need for sophisticated transaxle systems that can seamlessly integrate with advanced driver-assistance systems becomes paramount. These systems require precise control and responsiveness, which modern transaxles are designed to provide. Industry forecasts indicate that the autonomous vehicle market could reach a valuation of over 500 billion by 2030, creating substantial opportunities for transaxle manufacturers. Consequently, the Automotive Transaxle Market is likely to evolve in tandem with advancements in autonomous driving technologies.

Regulatory Pressures and Emission Standards

The Automotive Transaxle Market is significantly impacted by regulatory pressures and stringent emission standards imposed by governments worldwide. As nations implement more rigorous environmental regulations, automakers are compelled to enhance the efficiency of their vehicles, which directly influences transaxle design and functionality. Compliance with these standards often necessitates the integration of advanced transaxle technologies that optimize fuel consumption and reduce emissions. Recent data indicates that vehicles meeting the latest emission standards can achieve up to 25% lower emissions compared to their predecessors. Therefore, the Automotive Transaxle Market is likely to see increased demand for innovative solutions that help manufacturers comply with evolving regulations.

Technological Advancements in Transaxle Design

The Automotive Transaxle Market is witnessing a wave of technological advancements that are reshaping transaxle design and functionality. Innovations such as dual-clutch systems and continuously variable transmissions are becoming increasingly prevalent, offering improved performance and efficiency. These advancements not only enhance driving experience but also contribute to reduced emissions. Market data suggests that the adoption of advanced transaxle technologies could lead to a 15% reduction in CO2 emissions from passenger vehicles. As manufacturers strive to remain competitive, the Automotive Transaxle Market is likely to benefit from ongoing research and development efforts aimed at optimizing transaxle performance.

.png)