Market Growth Projections

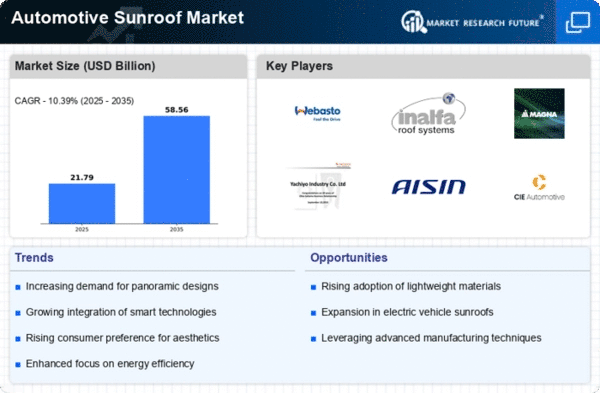

The Global Automotive Sunroof Market Industry is projected to experience robust growth, with estimates indicating a market value of 19.7 USD Billion in 2024 and a remarkable increase to 58.6 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 10.39% from 2025 to 2035, reflecting the increasing integration of sunroofs in various vehicle segments. The expansion of the market is likely driven by factors such as rising consumer demand for luxury features, technological advancements, and a growing focus on vehicle customization. These projections highlight the dynamic nature of the Global Automotive Sunroof Market Industry and its potential to adapt to evolving consumer preferences.

Growing Awareness of Health Benefits

Growing awareness of the health benefits associated with natural light and fresh air is influencing the Global Automotive Sunroof Market Industry. Consumers are increasingly recognizing the positive effects of sunlight exposure on mood and well-being, leading to a preference for vehicles equipped with sunroofs. This trend is particularly relevant in urban areas, where individuals seek to enhance their driving experience and connect with the outdoors. As a result, manufacturers are likely to emphasize the health benefits of sunroofs in their marketing strategies, potentially boosting sales and contributing to the overall growth of the market. The Global Automotive Sunroof Market Industry is poised to benefit from this shift in consumer mindset.

Increased Focus on Vehicle Customization

The Global Automotive Sunroof Market Industry is witnessing an increased focus on vehicle customization, as consumers seek to personalize their vehicles to reflect individual preferences. Sunroofs, being a prominent feature, offer an opportunity for manufacturers to cater to this demand. Customization options, such as different sunroof styles and sizes, allow consumers to choose features that align with their lifestyle and aesthetic preferences. This trend is particularly prevalent among younger consumers who prioritize unique vehicle characteristics. As manufacturers respond to this demand for customization, the Global Automotive Sunroof Market Industry is likely to experience sustained growth, driven by evolving consumer preferences.

Rising Consumer Demand for Luxury Features

The Global Automotive Sunroof Market Industry is experiencing a notable surge in consumer demand for luxury features in vehicles. As consumers increasingly seek enhanced driving experiences, sunroofs have become a sought-after feature, contributing to the overall appeal of vehicles. This trend is particularly evident in premium and luxury car segments, where sunroofs are often considered essential. The market is projected to reach 19.7 USD Billion in 2024, reflecting a growing inclination towards vehicles equipped with sunroofs. This demand is likely to drive manufacturers to innovate and incorporate advanced sunroof technologies, further propelling the Global Automotive Sunroof Market Industry.

Technological Advancements in Sunroof Design

Technological advancements play a pivotal role in shaping the Global Automotive Sunroof Market Industry. Innovations such as panoramic sunroofs, solar-powered sunroofs, and smart glass technologies are gaining traction among consumers. These advancements not only enhance aesthetic appeal but also improve energy efficiency and vehicle functionality. For instance, solar-powered sunroofs can harness sunlight to power vehicle systems, appealing to environmentally conscious consumers. As these technologies evolve, they are expected to attract a broader customer base, thereby contributing to the anticipated growth of the market, projected to reach 58.6 USD Billion by 2035.

Regulatory Support for Eco-Friendly Technologies

Regulatory support for eco-friendly technologies is emerging as a significant driver for the Global Automotive Sunroof Market Industry. Governments worldwide are implementing policies that encourage the adoption of sustainable automotive technologies, including sunroofs that utilize solar energy. This regulatory environment is fostering innovation and investment in the development of eco-friendly sunroof solutions. As manufacturers align their product offerings with these regulations, the market is expected to witness increased growth. The anticipated compound annual growth rate of 10.39% from 2025 to 2035 underscores the potential for the Global Automotive Sunroof Market Industry to thrive in this supportive regulatory landscape.