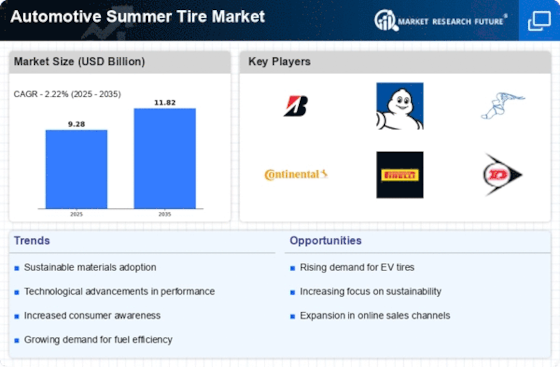

Increasing Vehicle Production

The Automotive Summer Tire Market is experiencing growth due to the rising production of vehicles. As manufacturers ramp up output to meet consumer demand, the need for high-quality summer tires becomes paramount. In 2025, vehicle production is projected to reach approximately 90 million units, which directly correlates with the demand for summer tires. This increase in production is driven by factors such as economic recovery and consumer preference for personal mobility. Consequently, tire manufacturers are likely to expand their operations to cater to this burgeoning market, thereby enhancing the Automotive Summer Tire Market.

Expansion of E-commerce Platforms

The Automotive Summer Tire Market is witnessing a shift towards e-commerce as a primary sales channel. With the proliferation of online shopping, consumers are increasingly purchasing tires through digital platforms. This trend is supported by data indicating that online tire sales have grown by over 30% in recent years. E-commerce provides consumers with the convenience of comparing prices and accessing a wider range of products. As a result, tire manufacturers and retailers are likely to enhance their online presence, thereby contributing to the growth of the Automotive Summer Tire Market.

Regulatory Standards and Safety Compliance

The Automotive Summer Tire Market is influenced by stringent regulatory standards aimed at enhancing vehicle safety. Governments are implementing regulations that require tires to meet specific performance criteria, including wet grip and rolling resistance. Compliance with these standards is essential for manufacturers, as non-compliance can lead to penalties and loss of market access. As a result, tire manufacturers are investing in research and development to ensure their products meet these regulations, thereby driving innovation within the Automotive Summer Tire Market. This focus on safety is likely to bolster consumer confidence and increase demand.

Rising Consumer Awareness of Tire Performance

Consumer awareness regarding the performance characteristics of tires is on the rise, significantly impacting the Automotive Summer Tire Market. As drivers become more informed about the benefits of summer tires, including improved handling and fuel efficiency, the demand for these products is expected to increase. Research indicates that consumers are willing to invest in premium summer tires, which can enhance vehicle performance. This trend is likely to drive sales in the Automotive Summer Tire Market, as manufacturers respond by developing innovative tire technologies that cater to performance-oriented consumers.

Technological Innovations in Tire Manufacturing

Technological advancements in tire manufacturing are playing a crucial role in shaping the Automotive Summer Tire Market. Innovations such as the use of advanced materials and smart tire technology are enhancing tire performance and longevity. For instance, the introduction of silica-based compounds has improved wet traction and reduced rolling resistance. As manufacturers adopt these technologies, they are likely to attract a broader customer base seeking high-performance summer tires. This trend suggests a competitive landscape in the Automotive Summer Tire Market, where innovation becomes a key differentiator among brands.