Emergence of Electric Vehicles

The Automotive Speedometer Cable Market is witnessing a shift due to the emergence of electric vehicles (EVs). As the automotive landscape evolves, manufacturers are adapting their product offerings to cater to the unique requirements of EVs, which often utilize digital speedometers. This transition presents both challenges and opportunities for the speedometer cable market. While traditional mechanical cables may see a decline in demand, there is a growing need for advanced electronic solutions that integrate seamlessly with EV technology. Market analysts suggest that the rise of EVs could lead to a transformation in the Automotive Speedometer Cable Market, as companies innovate to develop new products that align with the electrification trend.

Growth of the Automotive Industry

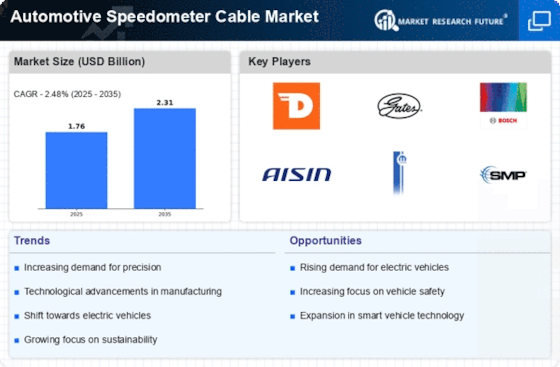

The Automotive Speedometer Cable Market is benefiting from the overall growth of the automotive sector. As vehicle production continues to rise, the demand for essential components, including speedometer cables, is also increasing. Recent data indicates that the automotive industry is projected to expand at a rate of approximately 3% annually, driven by factors such as rising disposable incomes and urbanization. This growth is likely to create a favorable environment for manufacturers of speedometer cables, as they seek to capitalize on the increasing production volumes. Additionally, the shift towards more fuel-efficient and technologically advanced vehicles is expected to further stimulate demand for high-quality speedometer cables, thereby enhancing the Automotive Speedometer Cable Market.

Rising Demand for Vehicle Customization

The Automotive Speedometer Cable Market is significantly influenced by the rising demand for vehicle customization. Consumers are increasingly seeking personalized features in their vehicles, which includes modifications to speedometer systems. This trend is particularly evident in the aftermarket segment, where enthusiasts are willing to invest in high-performance speedometer cables that offer enhanced accuracy and aesthetics. The customization trend is expected to drive sales in the Automotive Speedometer Cable Market, as manufacturers respond to consumer preferences by offering a wider range of products. Market data suggests that the aftermarket for automotive parts, including speedometer cables, is anticipated to grow steadily, with a projected increase of around 5% annually. This growth reflects the evolving consumer landscape and the importance of tailored automotive solutions.

Regulatory Compliance and Safety Standards

The Automotive Speedometer Cable Market is increasingly shaped by stringent regulatory compliance and safety standards. Governments and regulatory bodies are implementing more rigorous guidelines to ensure the safety and reliability of automotive components, including speedometer cables. Compliance with these regulations is essential for manufacturers to maintain market access and consumer trust. As a result, companies are investing in quality assurance processes and certifications to meet these standards. Recent statistics indicate that the automotive industry is expected to allocate a significant portion of its budget towards compliance-related initiatives, which could reach up to 10% of total operational costs. This focus on safety and compliance is likely to drive innovation and quality improvements within the Automotive Speedometer Cable Market.

Technological Advancements in Automotive Speedometer Cable Market

The Automotive Speedometer Cable Market is experiencing a notable transformation due to rapid technological advancements. Innovations in materials and manufacturing processes are enhancing the durability and performance of speedometer cables. For instance, the introduction of high-strength polymers and composite materials is likely to improve resistance to wear and tear, thereby extending the lifespan of these components. Furthermore, advancements in production techniques, such as precision molding and automated assembly, are reducing costs and increasing efficiency. According to recent data, the market for automotive components, including speedometer cables, is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This growth is indicative of the increasing demand for reliable and efficient automotive parts, which is a driving force in the Automotive Speedometer Cable Market.