North America : Market Leader in Innovation

North America is poised to maintain its leadership in the Automotive Software Support and Repair Market, holding a significant market share of 23.75 in 2024. The region's growth is driven by increasing vehicle electrification, advancements in autonomous driving technologies, and stringent regulatory standards aimed at enhancing vehicle safety and emissions. The demand for software solutions that support these innovations is surging, supported by government initiatives promoting smart transportation systems.

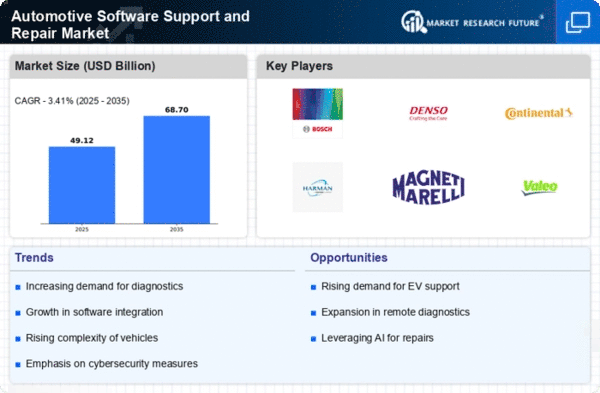

Leading countries such as the US and Canada are at the forefront of this market, with major players like Bosch, Denso, and Harman establishing a strong presence. The competitive landscape is characterized by continuous innovation and strategic partnerships among key players, ensuring a robust supply chain. The focus on research and development is critical, as companies strive to meet evolving consumer demands and regulatory requirements, solidifying North America's position as a global hub for automotive software solutions.

Europe : Emerging Hub for Technology

Europe is emerging as a vital hub for the Automotive Software Support and Repair Market, with a market size of 12.5 in 2024. The region's growth is fueled by increasing investments in electric vehicles (EVs) and stringent EU regulations aimed at reducing carbon emissions. The demand for advanced software solutions is rising, driven by the need for enhanced vehicle connectivity and safety features, aligning with the EU's Green Deal objectives.

Countries like Germany, France, and the UK are leading the charge, with key players such as Continental, Valeo, and Aptiv actively contributing to market growth. The competitive landscape is marked by innovation and collaboration among automotive manufacturers and software developers. As the region transitions towards sustainable mobility, the focus on software support and repair solutions is expected to intensify, ensuring compliance with evolving regulations and consumer expectations.

Asia-Pacific : Rapidly Growing Market Potential

Asia-Pacific is witnessing rapid growth in the Automotive Software Support and Repair Market, with a market size of 8.75 in 2024. The region's expansion is driven by increasing vehicle production, rising disposable incomes, and a growing demand for advanced automotive technologies. Government initiatives promoting smart transportation and electric vehicles are further catalyzing market growth, creating a favorable environment for software solutions.

Leading countries such as Japan, China, and South Korea are at the forefront of this market, with key players like Denso and ZF Friedrichshafen making significant contributions. The competitive landscape is characterized by a mix of established companies and emerging startups, fostering innovation and technological advancements. As the region continues to embrace digital transformation in the automotive sector, the demand for software support and repair solutions is expected to rise significantly, aligning with consumer preferences and regulatory standards.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa region is gradually emerging in the Automotive Software Support and Repair Market, with a market size of 2.5 in 2024. The growth is primarily driven by increasing vehicle ownership, urbanization, and a rising focus on automotive safety and technology. Government initiatives aimed at enhancing transportation infrastructure and promoting smart mobility solutions are also contributing to market development, creating opportunities for software solutions.

Countries like South Africa and the UAE are leading the market, with a growing presence of key players looking to capitalize on the region's potential. The competitive landscape is evolving, with both local and international companies vying for market share. As the region continues to develop its automotive sector, the demand for software support and repair solutions is expected to grow, driven by consumer needs and regulatory frameworks.