North America : Market Leader in Innovation

North America is poised to maintain its leadership in the automotive technical support services market, holding a significant share of 5.0 USD billion in 2024. The region's growth is driven by increasing vehicle complexity, advancements in technology, and a strong regulatory framework promoting safety and efficiency. Demand for electric and autonomous vehicles is also propelling the need for specialized support services, ensuring a robust market environment.

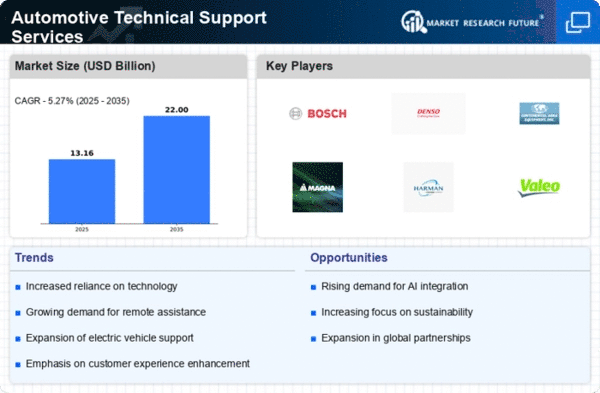

The competitive landscape is characterized by major players such as Robert Bosch GmbH, Denso Corporation, and Magna International Inc. These companies are leveraging their technological expertise and extensive service networks to capture market share. The U.S. and Canada are the leading countries, with a focus on innovation and customer-centric solutions, further solidifying North America's position as a hub for automotive technical support services.

Europe : Emerging Hub for Technology

Europe's automotive technical support services market is projected to grow, with a market size of 3.5 USD billion in 2024. The region benefits from stringent regulations aimed at enhancing vehicle safety and environmental standards, which drive demand for advanced technical support services. The push towards electric vehicles and sustainable practices is also a significant growth driver, as manufacturers seek to comply with evolving regulations and consumer expectations.

Leading countries in this region include Germany, France, and the UK, where key players like Continental AG and Valeo SA are actively expanding their service offerings. The competitive landscape is marked by innovation and collaboration among industry stakeholders, ensuring that Europe remains a vital player in The Automotive Technical Support Services. "The automotive sector is undergoing a transformation, and our regulations are designed to support this evolution," states the European Commission.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region is witnessing a surge in the automotive technical support services market, with a size of 3.0 USD billion in 2024. This growth is fueled by rising vehicle ownership, urbanization, and increasing consumer demand for advanced automotive technologies. Governments are also implementing supportive policies to enhance vehicle safety and efficiency, further driving the need for specialized support services in the region.

Countries like Japan, China, and South Korea are at the forefront of this growth, with key players such as Denso Corporation and Aptiv PLC leading the charge. The competitive landscape is dynamic, with a focus on innovation and customer service excellence. As the region continues to evolve, the demand for technical support services is expected to rise significantly, positioning Asia-Pacific as a critical market in the global automotive landscape.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is gradually emerging in the automotive technical support services market, with a size of 1.0 USD billion USD billion in 2024. The growth is driven by increasing vehicle sales, urbanization, and a growing middle class seeking advanced automotive solutions. Additionally, government initiatives aimed at improving road safety and vehicle standards are catalyzing demand for technical support services in the region.

Leading countries include South Africa and the UAE, where local and international players are beginning to establish a foothold. The competitive landscape is still developing, but there are significant opportunities for growth as the region invests in infrastructure and automotive technology. The presence of key players like Harman International and ZF Friedrichshafen AG is expected to enhance service offerings and drive market expansion.