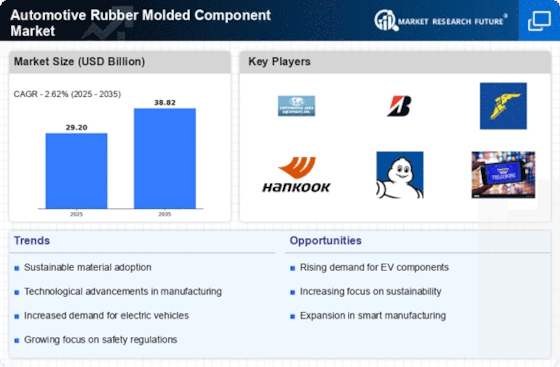

Growth of the Automotive Aftermarket

The Automotive Rubber Molded Component Market is significantly influenced by the expansion of the automotive aftermarket. As vehicle ownership rates rise, the need for replacement parts and accessories is also increasing. The aftermarket segment is projected to grow at a robust pace, with estimates indicating a potential increase of over 5% annually. This growth is driven by factors such as the aging vehicle population and the rising trend of vehicle customization. Consequently, the demand for rubber molded components, including seals, gaskets, and bushings, is expected to rise, providing lucrative opportunities for manufacturers in the aftermarket sector.

Increasing Demand for Automotive Safety Features

The Automotive Rubber Molded Component Market is experiencing a notable surge in demand for enhanced safety features in vehicles. As consumers become more safety-conscious, manufacturers are compelled to integrate advanced safety technologies, which often require specialized rubber components. For instance, airbags, seals, and gaskets are critical in ensuring vehicle safety and performance. The market for automotive safety systems is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 7% in the coming years. This trend indicates that the automotive sector is increasingly prioritizing safety, thereby driving the demand for high-quality rubber molded components that meet stringent safety standards.

Regulatory Compliance and Environmental Standards

The Automotive Rubber Molded Component Market is increasingly shaped by stringent regulatory compliance and environmental standards. Governments worldwide are implementing regulations aimed at reducing emissions and promoting sustainable practices within the automotive sector. This has led to a heightened focus on the development of eco-friendly rubber materials and manufacturing processes. Companies that prioritize compliance with these regulations are likely to gain a competitive edge, as consumers are becoming more environmentally conscious. The shift towards sustainable materials is expected to drive innovation in the rubber molded components market, fostering growth and adaptation to new industry standards.

Rising Popularity of Electric and Hybrid Vehicles

The Automotive Rubber Molded Component Market is witnessing a shift due to the rising popularity of electric and hybrid vehicles. As these vehicles become more prevalent, the demand for specialized rubber components tailored to their unique requirements is increasing. Electric vehicles often require advanced sealing solutions to enhance battery performance and safety. The market for electric vehicles is projected to grow exponentially, with estimates suggesting a compound annual growth rate of over 20% in the next few years. This trend indicates a significant opportunity for manufacturers of rubber molded components to innovate and cater to the specific needs of electric and hybrid vehicle manufacturers.

Technological Advancements in Manufacturing Processes

Technological innovations in manufacturing processes are transforming the Automotive Rubber Molded Component Market. The adoption of advanced techniques such as 3D printing and automation is enhancing production efficiency and precision. These technologies allow manufacturers to produce complex rubber components with reduced lead times and lower costs. Moreover, the integration of smart manufacturing practices is likely to improve quality control and reduce waste, aligning with the industry's sustainability goals. As a result, manufacturers are better positioned to meet the evolving demands of the automotive sector, which is increasingly focused on innovation and efficiency.