Regulatory Compliance

Regulatory compliance is a significant driver in the Automotive Production Market. Governments worldwide are implementing stricter emissions standards and safety regulations, compelling manufacturers to adapt their production processes. In 2025, it is anticipated that compliance costs will account for approximately 15% of total production expenses for automotive companies. This necessitates investments in research and development to innovate cleaner technologies and enhance vehicle safety features. Furthermore, adherence to these regulations not only ensures market access but also fosters consumer trust. As regulatory frameworks continue to evolve, the Automotive Production Market must remain agile to meet these challenges.

Supply Chain Resilience

Supply chain resilience has become a critical focus within the Automotive Production Market. Recent disruptions have highlighted the vulnerabilities in traditional supply chains, prompting manufacturers to adopt more robust strategies. In 2025, it is projected that 60% of automotive companies will prioritize local sourcing to mitigate risks associated with global supply chains. This shift not only enhances supply chain reliability but also supports local economies. Additionally, investments in digital supply chain technologies are expected to increase, allowing for better visibility and responsiveness. As a result, the emphasis on supply chain resilience is likely to redefine operational strategies within the Automotive Production Market.

Technological Integration

Technological integration plays a pivotal role in the Automotive Production Market. The adoption of advanced manufacturing technologies, such as automation and artificial intelligence, is streamlining production processes and improving efficiency. In 2025, it is estimated that over 30% of automotive manufacturers have implemented smart factory solutions, which enhance productivity and reduce operational costs. Furthermore, the integration of Internet of Things (IoT) devices allows for real-time monitoring of production lines, leading to quicker decision-making and reduced downtime. This technological evolution not only boosts competitiveness but also addresses the increasing complexity of modern vehicle designs, thereby transforming the Automotive Production Market.

Sustainability Initiatives

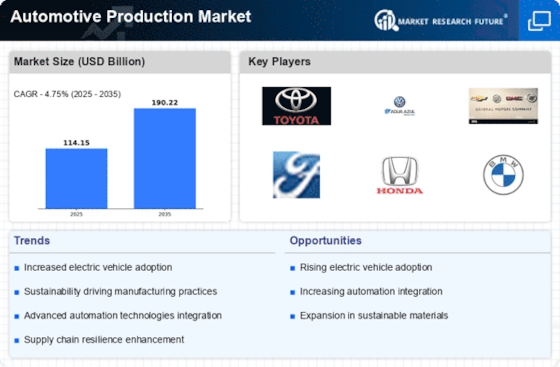

The Automotive Production Market is increasingly influenced by sustainability initiatives. Manufacturers are adopting eco-friendly practices to reduce their carbon footprint and meet regulatory requirements. This shift is evident in the growing demand for electric vehicles (EVs), which accounted for approximately 10% of total vehicle sales in 2025. Additionally, the use of recyclable materials in production processes is becoming more prevalent, as companies aim to minimize waste. The push for sustainability not only aligns with consumer preferences but also enhances brand reputation. As a result, investments in green technologies and sustainable supply chains are expected to rise, further shaping the Automotive Production Market.

Consumer-Centric Customization

Consumer-centric customization is emerging as a key driver in the Automotive Production Market. As consumers seek personalized experiences, manufacturers are responding by offering customizable vehicle options. In 2025, surveys indicate that nearly 40% of potential car buyers express a preference for vehicles that can be tailored to their specifications. This trend is prompting manufacturers to invest in flexible production systems that can accommodate diverse consumer preferences without compromising efficiency. By leveraging data analytics and customer feedback, companies can better understand market demands and enhance their product offerings. Consequently, this focus on customization is reshaping the competitive landscape of the Automotive Production Market.