Technological Advancements in Sensor Technologies

Technological advancements in sensor technologies are significantly influencing the Automotive Predictive Technology Market. The integration of high-resolution cameras, LiDAR, and radar systems enables vehicles to gather real-time data about their surroundings. This data is crucial for predictive analytics, allowing for improved decision-making processes in autonomous driving systems. The market for sensor technologies is expected to expand, with estimates suggesting a growth rate of around 15% annually. As these technologies evolve, they enhance the capabilities of predictive systems, making vehicles smarter and more responsive. Consequently, the Automotive Predictive Technology Market is poised for growth as manufacturers increasingly adopt these advanced sensor technologies.

Growing Consumer Preference for Connected Vehicles

Consumer preferences are shifting towards connected vehicles, which is a key driver for the Automotive Predictive Technology Market. Connected vehicles utilize predictive technology to enhance user experience through features such as real-time traffic updates, predictive maintenance alerts, and personalized driving experiences. Market Research Future indicates that the connected vehicle segment is expected to grow at a rate of approximately 25% in the coming years. This trend is fueled by the increasing reliance on mobile technology and the desire for seamless connectivity. As more consumers opt for connected vehicles, the Automotive Predictive Technology Market is likely to expand, driven by the demand for innovative predictive solutions.

Regulatory Support for Safety and Emission Standards

Regulatory support for safety and emission standards is a significant driver for the Automotive Predictive Technology Market. Governments worldwide are implementing stringent regulations aimed at enhancing vehicle safety and reducing emissions. These regulations often necessitate the incorporation of predictive technologies to meet compliance requirements. For instance, the introduction of new safety standards may require the integration of predictive analytics in vehicle systems to monitor and improve safety performance. As regulatory frameworks evolve, the Automotive Predictive Technology Market is expected to grow, as manufacturers seek to align their products with these standards, thereby fostering innovation in predictive technologies.

Rising Demand for Advanced Driver Assistance Systems

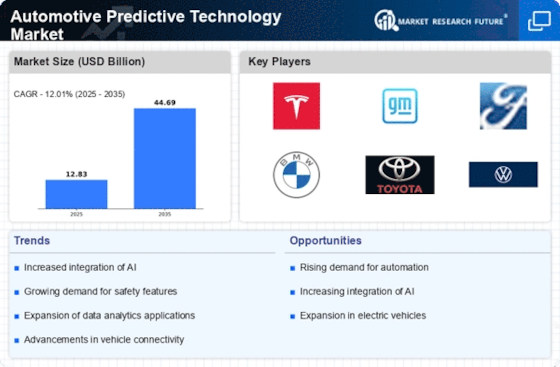

The Automotive Predictive Technology Market is experiencing a notable surge in demand for advanced driver assistance systems (ADAS). These systems enhance vehicle safety and improve the driving experience by utilizing predictive analytics to anticipate potential hazards. According to recent data, the ADAS segment is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This growth is driven by increasing consumer awareness regarding road safety and the regulatory push for enhanced safety features in vehicles. As automakers integrate predictive technologies into their ADAS offerings, the Automotive Predictive Technology Market is likely to witness substantial advancements, leading to safer and more efficient driving environments.

Increasing Investment in Autonomous Vehicle Development

The Automotive Predictive Technology Market is witnessing a surge in investment directed towards the development of autonomous vehicles. Major automotive manufacturers and technology companies are allocating substantial resources to research and development in this area. Reports indicate that investments in autonomous vehicle technology could exceed $100 billion over the next decade. This influx of capital is likely to accelerate the integration of predictive technologies, which are essential for the safe operation of autonomous vehicles. As the industry progresses towards fully autonomous driving, the demand for sophisticated predictive analytics will grow, further propelling the Automotive Predictive Technology Market.