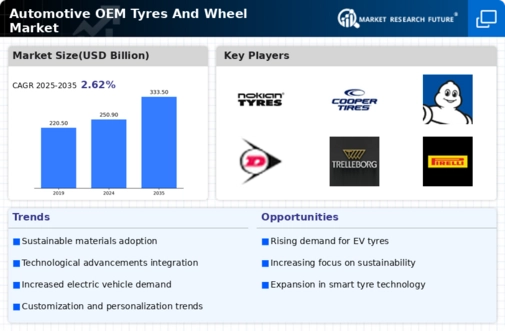

Rising Vehicle Production

The Automotive OEM Tyres And Wheel Market is experiencing a surge in vehicle production, driven by increasing consumer demand for personal and commercial vehicles. In recent years, production levels have shown a steady upward trend, with millions of vehicles manufactured annually. This growth in production directly correlates with the demand for OEM tyres and wheels, as manufacturers seek to equip new vehicles with high-quality components. The expansion of automotive manufacturing facilities in various regions further supports this trend, indicating a robust market environment. As vehicle production continues to rise, the Automotive OEM Tyres And Wheel Market is likely to benefit from increased sales and opportunities for innovation in tyre and wheel design.

Growth of Electric Vehicle Market

The growth of the electric vehicle market is a pivotal driver for the Automotive OEM Tyres And Wheel Market. As more consumers and manufacturers shift towards electric vehicles, there is an increasing need for tyres specifically designed to meet the unique requirements of EVs. These tyres must accommodate the higher torque and weight of electric vehicles while ensuring optimal performance and efficiency. Market data indicates that the electric vehicle segment is expanding rapidly, with projections suggesting that EV sales could account for a significant portion of total vehicle sales in the coming years. This shift presents a substantial opportunity for the Automotive OEM Tyres And Wheel Market to innovate and develop specialised products tailored for electric vehicles.

Increasing Focus on Safety Standards

The Automotive OEM Tyres And Wheel Market is witnessing a heightened focus on safety standards, which is shaping the demand for high-quality tyres and wheels. Regulatory bodies are implementing stricter safety regulations, compelling manufacturers to prioritize safety features in their products. This trend is particularly evident in the development of tyres that offer better grip, stability, and performance under various driving conditions. As consumers become more safety-conscious, the demand for tyres that meet or exceed these standards is expected to rise. Consequently, this focus on safety is likely to drive innovation and investment in the Automotive OEM Tyres And Wheel Market, as manufacturers strive to meet evolving consumer expectations.

Sustainability and Eco-Friendly Practices

Sustainability and eco-friendly practices are becoming increasingly important in the Automotive OEM Tyres And Wheel Market. Consumers are showing a growing preference for products that are environmentally friendly, prompting manufacturers to adopt sustainable practices in tyre production. This includes the use of renewable materials, recycling initiatives, and reducing carbon footprints during manufacturing processes. As regulations around environmental impact become more stringent, companies that prioritise sustainability are likely to gain a competitive edge. The shift towards eco-friendly tyres not only meets consumer demand but also aligns with broader industry trends towards sustainability, thereby driving growth in the Automotive OEM Tyres And Wheel Market.

Technological Advancements in Tyre Manufacturing

Technological advancements in tyre manufacturing are significantly influencing the Automotive OEM Tyres And Wheel Market. Innovations such as advanced materials, smart tyres, and automated production processes are enhancing the performance and durability of tyres. For instance, the introduction of lightweight materials not only improves fuel efficiency but also contributes to better handling and safety. Furthermore, the integration of sensors in tyres allows for real-time monitoring of tyre pressure and temperature, which can prevent accidents and extend tyre life. These advancements are likely to attract OEMs looking to enhance their vehicle offerings, thereby driving growth in the Automotive OEM Tyres And Wheel Market.