Automotive Magnet Wire Size

Automotive Magnet Wire Market Growth Projections and Opportunities

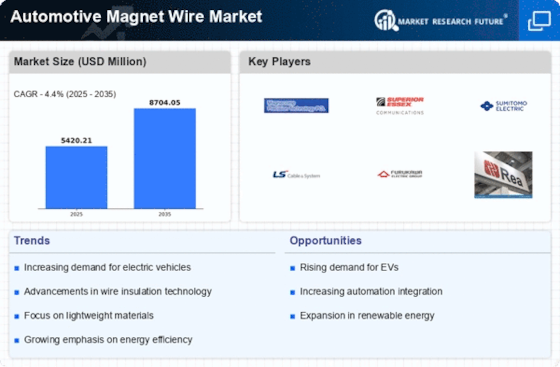

The Automotive Magnet Wire Market is affected by a number of growth factors. All these factors together determine how the market operates. Magnet wire, commonly known as winding wire or coil wire, is one of the vital parts used in the tire building process and making of electric motors and transformers. Growing demand for Electric Vehicles (EV's) is one of the key factors that pushes the Automotive Magnet Wire Market forward. The market follows the automotive industry trail by electrifying itself, with its demand for wire winding increasing as more electric motors are used for EVs to power their electric vehicles, in turn, boosting the growth of the market.

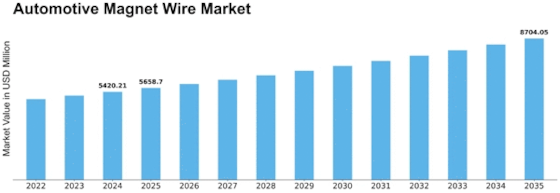

In 2022, the Global Milepost for Automotive Magnet Wire was $4,972.96 million. The current state of the Automotive Magnet Wire market shows a potential growth rate which is stuck at USD 6,991.12 million by 2030 with a compound annual growth rate (CAGR) of 4.40%.

Development of heat resistant & high purity materials as well as magnet winding processes is the core factor dictating the future of the Automotive Magnet Wire Market. Continual research and development with an aim to maximize the conduction efficiency, thermal stability and mechanical strength of the magnet wires is evidently encouraged. The latest trends in the insulation materials, winding techniques and coating technologies aim to improve the reliability and operating efficiency of electric motors, thereby meeting the stringent standards in the automotive industry.

National and governmental guidelines and rules for an environmental sector are central in the Automotive Magnet Wire Market. Rules for more fuel efficiency, contenting carbon emissions and developing an electric vehicle market support this market growth. The incentives and mandates for the automakers to enhance the production of electric and hybrid vehicles even more escalate the demand for magnet wire in less sophisticated automotive.

A notable aspect of the Automotive industry is the drive for sustainability and energy mergence which in turn impacts the Automotive Magnet Wire Market. Magnet wire is an important part of new electric motors, these induction motors have better energy utilisation and lower carbon dioxide emission than the conventional internal combustion engines (ICEs). With automakers concentrating on environment-protective technologies, electric and hybrid vehicles have been more on people’s radar and the demand for magnet wire is increasing for this kind of vehicle.

The consumer behaviour, as well as economic factors contribute to the growth of Automotive Magnet Wire Market. Economic growth, consumer awareness of environmental causes increased, and government initiatives aiming at the EV market contribute to the development of such use by the industry. However, a recession might have the opposite effect on the market as the consumer's purchasing power and the governmental investments are altered respectively.

Leave a Comment