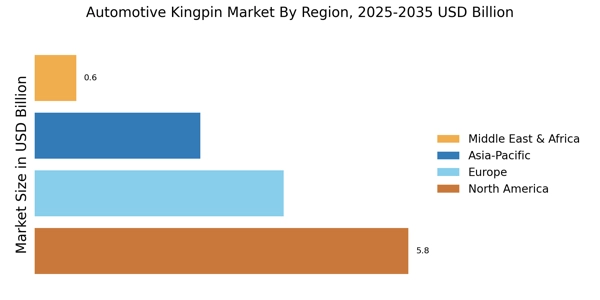

North America : Market Leader in Innovation

North America is the largest market for automotive kingpins, holding approximately 45% of the global share. The region's growth is driven by increasing vehicle production, stringent safety regulations, and advancements in automotive technology. The demand for heavy-duty vehicles and commercial trucks is also on the rise, further propelling market growth. Regulatory catalysts, such as the National Highway Traffic Safety Administration (NHTSA) standards, are enhancing safety features in vehicles, thereby boosting the demand for high-quality kingpins. The United States is the leading country in this market, followed by Canada. Major players like Meritor Inc, Dana Incorporated, and Wabco Holdings Inc are headquartered in this region, contributing significantly to the competitive landscape. The presence of these key players ensures a robust supply chain and innovation in product offerings, catering to the growing demand for advanced automotive components. The competitive environment is characterized by strategic partnerships and technological advancements, positioning North America as a hub for automotive innovation.

Europe : Emerging Market with Regulations

Europe is the second-largest market for automotive kingpins, accounting for approximately 30% of the global market share. The region's growth is fueled by increasing investments in electric vehicles and stringent environmental regulations. The European Union's focus on reducing carbon emissions is driving manufacturers to innovate and adopt sustainable practices, which in turn boosts the demand for advanced automotive components, including kingpins. Regulatory frameworks, such as the EU's General Safety Regulation, are also enhancing safety standards in vehicles, further stimulating market growth. Germany, France, and the UK are the leading countries in this market, with Germany being the largest contributor. Key players like ZF Friedrichshafen AG, Schaeffler AG, and Knorr-Bremse AG are prominent in the region, driving competition and innovation. The competitive landscape is characterized by a mix of established companies and emerging startups, all striving to meet the evolving demands of the automotive industry. The presence of these key players ensures a dynamic market environment, fostering advancements in technology and product offerings.

Asia-Pacific : Rapid Growth and Demand Surge

Asia-Pacific is witnessing rapid growth in the automotive kingpin market, holding approximately 20% of the global share. The region's growth is driven by increasing vehicle production, urbanization, and rising disposable incomes. Countries like China and India are experiencing a surge in demand for commercial vehicles, which is significantly boosting the market for kingpins. Additionally, government initiatives aimed at promoting manufacturing and infrastructure development are acting as catalysts for market growth, creating a favorable environment for automotive component manufacturers. China is the largest market in this region, followed by India and Japan. The competitive landscape is marked by the presence of both local and international players, including Haldex AB and Continental AG. These companies are focusing on innovation and expanding their product portfolios to cater to the growing demand. The region's market is characterized by intense competition, with companies investing in research and development to enhance product quality and performance, ensuring they meet the evolving needs of the automotive sector.

Middle East and Africa : Untapped Potential and Growth

The Middle East and Africa region is gradually emerging in the automotive kingpin market, holding approximately 5% of the global share. The growth in this region is primarily driven by increasing investments in infrastructure and a growing automotive sector. Countries like South Africa and the UAE are witnessing a rise in vehicle production and demand for commercial vehicles, which is positively impacting the kingpin market. Additionally, government initiatives aimed at boosting local manufacturing are creating opportunities for market players to expand their operations in this region. South Africa is the leading country in this market, with a growing presence of international players looking to tap into the region's potential. The competitive landscape is characterized by a mix of established companies and new entrants, all vying for market share. The presence of key players is gradually increasing, with companies focusing on enhancing their product offerings and establishing local partnerships to cater to the unique demands of the market. This region presents significant growth opportunities for automotive component manufacturers.

.png)