Enhanced Vehicle Performance

The Automotive In Wheel Market is significantly influenced by the growing emphasis on enhanced vehicle performance. In-wheel motors provide superior torque and acceleration, which are essential for modern driving experiences. This technology allows for better weight distribution and improved handling, making vehicles more agile and responsive. As automotive manufacturers strive to differentiate their products in a competitive market, the integration of in-wheel motors is becoming increasingly attractive. Market data suggests that vehicles equipped with in-wheel technology can achieve up to 20% better energy efficiency compared to traditional setups. This performance advantage is likely to drive further adoption of in-wheel systems in various vehicle segments.

Growing Focus on Fuel Efficiency

The Automotive In Wheel Market is significantly impacted by the increasing focus on fuel efficiency among consumers and manufacturers alike. With rising fuel prices and environmental concerns, there is a pressing need for technologies that can enhance fuel economy. In-wheel motors contribute to this goal by reducing the overall weight of vehicles and improving energy conversion efficiency. Market analysis indicates that vehicles utilizing in-wheel technology can achieve fuel savings of up to 15% compared to conventional systems. This potential for improved fuel efficiency is likely to drive demand for in-wheel solutions, as automakers seek to meet consumer expectations and regulatory standards for emissions and fuel consumption.

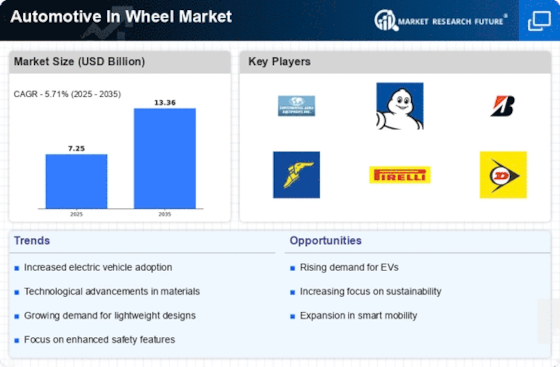

Rising Demand for Electric Vehicles

The Automotive In Wheel Market is experiencing a notable surge in demand for electric vehicles (EVs). As consumers increasingly prioritize sustainability and energy efficiency, automakers are responding by integrating advanced technologies into their vehicle designs. In 2025, it is estimated that EV sales will account for approximately 30% of total vehicle sales, driving the need for innovative solutions such as in-wheel motors. These motors not only enhance vehicle performance but also contribute to weight reduction, which is crucial for maximizing battery efficiency. Consequently, the Automotive In Wheel Market is likely to expand as manufacturers seek to capitalize on this trend, leading to increased investments in research and development of in-wheel technologies.

Regulatory Compliance and Emission Standards

The Automotive In Wheel Market is increasingly shaped by stringent regulatory compliance and emission standards imposed by governments worldwide. As nations implement more rigorous environmental regulations, automotive manufacturers are compelled to innovate and adopt cleaner technologies. In-wheel motors, which can significantly reduce vehicle emissions, are becoming a focal point for compliance strategies. The market is projected to expand as manufacturers seek to align their products with these evolving standards. In 2025, it is anticipated that a substantial percentage of new vehicles will be required to meet enhanced emission criteria, thereby driving the adoption of in-wheel technologies that facilitate compliance while also improving overall vehicle performance.

Technological Innovations in Automotive Design

The Automotive In Wheel Market is witnessing a wave of technological innovations that are reshaping automotive design. The advent of smart materials and advanced manufacturing techniques has enabled the development of lighter and more efficient in-wheel motors. These innovations not only improve the overall performance of vehicles but also facilitate the integration of autonomous driving technologies. As the automotive sector moves towards greater automation, the demand for in-wheel systems that can support these advancements is expected to rise. Furthermore, the market is projected to grow as manufacturers increasingly adopt modular designs that allow for easier upgrades and maintenance of in-wheel systems, thereby enhancing the overall vehicle lifecycle.